The JSE ended sharply lower on Tuesday as the broad based sell-off in global equities continued.

US equity markets recorded their biggest intra-day decline since December 2015 in Monday’s trading session, which saw the Dow Jones Industrial Index and S&P500 index lose 4.60% and 4.10% respectively. The sell-off persisted in Asian markets on Tuesday which also came under pressure, with the biggest loser being the Japanese Nikkei which lost 4.73%.

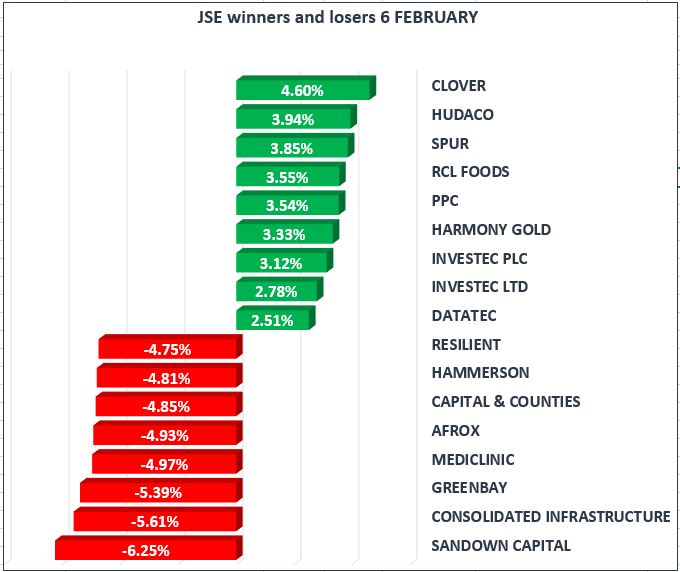

On the JSE, the ALSI futures opened down more than 1800 points at 48 900 points before clawing back some of the losses to close at 49 849 points, down 731 points for the day. The JSE Top-40 index had slightly better look today as a couple stocks managed to trade in positive territory. Gold mining stocks opened firmer due to the higher Gold prices overnight. Stocks such as Harmony Gold [JSE:HAR] and Gold Fields [JSE:GFI] gained 3.33% and 1.76% respectively. Other positive movers on the day were Investec Limited [JSE:INL] and Investec PLC [JSE:INV] which gained 2.78% and 3.12% respectively, whilst Spur Corporation [JSE:SUR] and Growthpoint Properties [JSE:GRT] gained 3.85% and 1.50% respectively.

On the losers side, listed property stocks continued to trade under pressure as Fortress B [JSE:FFB], Greenbay Properties [JSE:GRP] and Hammerson [JSE:HMN] lost 6.62%, 5.29% and 4.81% respectively. Mediclinic [JSE:MEI], Consolidated Infrastructure [JSE:CIL] and Adcock Ingram [JSE:AIP] shed 4.97%, 5.61% and 2.71% respectively. Naspers [JSE:NPN] came under significant pressure due to a sell-off in Tencent Holdings on the Hang Seng. The index heavyweight broke below R3000 per share to reach an intra-day low of R2976.68 per share, before rebounding to close at R3104.51 per share, down 0.5% for the day.

The JSE All-Share Index lost another 1.29% today, whilst the Top-40 Index lost 1.27%. All the major indices on the JSE were trading under pressure with the biggest loser being the Industrials Index which lost 1.35%, whilst the Resources Index and the Financials Index lost 1.27% and 0.88% respectively.

Brent Crude traded softer as it briefly broke below $66/barrel, but it quickly pared the losses to trade at $67.28/barrel just after the JSE close. On the JSE, Sasol [JSE:SOL] lost 1.63% to close at R404.90 per share.

Gold traded firmer earlier on but subsequently reversed all gains as the US dollar gained momentum. Gold was trading at $1330.97/Oz just after the JSE closed, after having managed to peak at $1346.21/Oz intra-day.

Palladium continued to lose ground as it shed more than 1.8% to reach an intra-day low of $1008.88/Oz. It rebounded slightly to trade at $1014.02/Oz just after the close. Platinum was mostly flat to trade at $990.77/Oz just after the JSE close.

US markets opened lower yet again with Dow Jones and S&P500 indices opening 2.18% and 1.82% lower respectively. However an hour into the session the indices were showing signs of a potential reversal into the green. The US 10-year Treasury bond yield was slightly lower at 2.76% at 5.30pm CAT.