The local bourse lost ground towards the close on Wednesday eventually erasing all its earlier gains.

Stocks were much more stable in today’s session following a sharp sell-off which engulfed most global markets on Tuesday. The JSE had some momentum at the open following firmer closes for the main Asian equity indexes. However, most of that momentum faded as the day went on as European equities struggled. US equity futures pointed higher on the back of positive sentiment from giants such as IBM and Netflix.

Statistics SA released inflation data for the month of December which came in slightly higher than forecasted. CPI YoY was recorded at 4.0% from a prior recording of 3.6%m while CPI MoM rose 0.3% from a prior recording of 0.1%. This comes on the back of the interest rate cut by the South African Reserve Bank at last week’s MPC meeting. The rand advanced primarily due to the weaker US dollar which saw the local currency peak at a session high of R14.37/$ before it was recorded trading 0.72% firmer at R14.38/$.

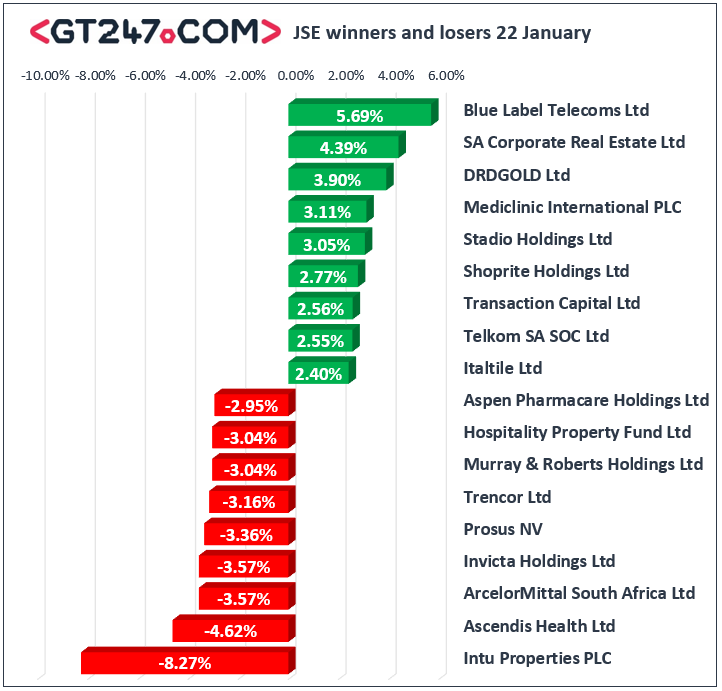

On the JSE, SA Corporate Real Estate [JSE:SAC] rallied 4.39% to close at R3.09, while Equities Property Fund [JSE:EQU] gained 1.53% to close at R19.88 on the back of the release of its transactional update. Shoprite Holdings [JSE:SHP] released a half-year operational update which highlighted healthy sales growth in its SA stores while stores in the rest of Africa struggled. The stock eventually closed 2.77% firmer at R118.08. The Spar Group [JSE:SPP] also found some momentum as it added 1.54% to close at R20.87. Mediclinic [JSE:MEI] surged 3.11% to close at R76.84, Telkom [JSE:TKG] added 2.55% to close at R35.76, and Bid Corporation [JSE:BID] rose 1.17% to close at R348.84.

Intu Properties [JSE:ITU] tumbled 8.27% to close at R3.77 while its industry peer Hammerson PLC [JSE:HMN] lost 1.19% to close at R47.30. Prosus [JSE:PRX] came under pressure as its biggest shareholder, Naspers announced that it had successfully sold 22 million Prosus N ordinary shares. Prosus eventually closed 3.36% lower at R1099.91. Retailers struggled on the day despite the rand trading firmer which saw losses being recorded for Woolworths [JSE:WHL] which lost 2.13% to close at R47.22, Pepkor Holdings [JSE:PPH] lost 2.38% at R16.84, and Lewis Group [JSE:LEW] closed at R32.00 after dropping 1.57%. Significant losses were also recorded for Quilter [JSE:QLT] which lost 2.62% to close at R30.453, and Sasol [JSE:SOL] which slipped 1.88% to close at R267.04.

The JSE All-Share index eventually closed 0.1% softer while the JSE Top-40 index closed 0.05% weaker. The Resources index managed to eke out gains of 0.08%, while the Industrials and Financials lost 0.11% and 0.12% respectively.

Brent crude was trading mostly weaker on the day and it was recorded trading 1.95% weaker at $63.34/barrel just after the JSE close.

At 17.00 CAT, Gold was down 0.06% weaker at $1557.00/Oz, Platinum was 1.2% firmer at $1011.29/Oz, and Palladium had surged 1.82% to trade at $2444.94/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.