The JSE fell on Wednesday as it tracked other global stocks lower as pessimism emanating from low manufacturing data spread.

With the Chinese markets still closed for a holiday, the Hang Seng and Nikkei lost 0.19% and 0.49% respectively as they reacted to worse than expected US economic data. European counters recorded significant losses as risk aversion saw investors dump stocks in search of safe-haven assets such as gold and treasury bonds. In the USA, stocks opened at their lowest level in over a month as investors ran. With no economic data coming out locally in today’s session, the JSE tracked this overall global sentiment.

On the currency market, emerging market currencies traded under pressure in earlier trading primarily on the back of US dollar strength, before a change in fortunes for the greenback saw most of them pare their losses. The rand slumped to a session low of R15.40 before it recouped all its losses to trade 0.38% firmer at R15.26/$ at 17.00 CAT.

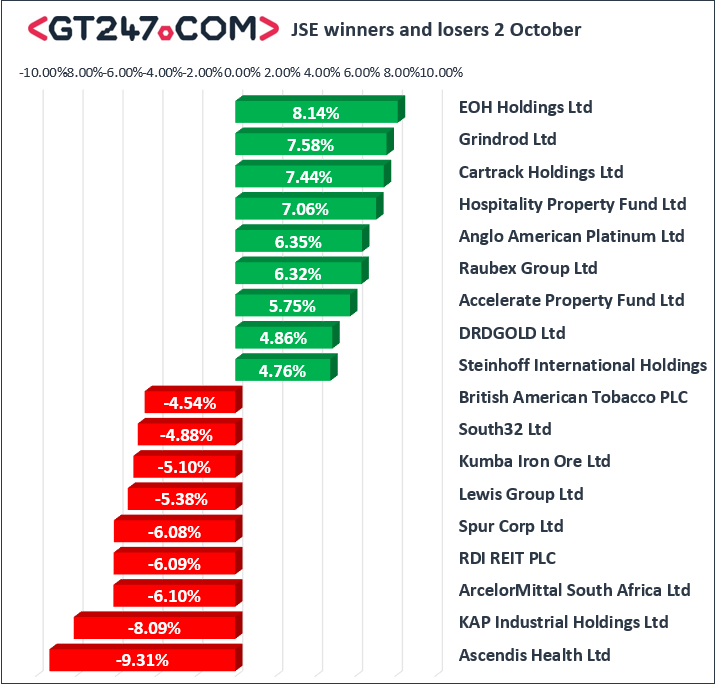

Weakness was recorded across the board except for a few miners. KAP Industrial Holdings [JSE:KAP] came under significant pressure as it closed 8.09% lower at R4.32, while RDI REIT [JSE:RPL] relinquished some of the prior session’s gains to end the day 6.09% weaker at R21.60. Mining giant BHP Group [JSE:BHP] tumbled 3.9% to close at R314.00, while South32 [JSE:S32] fell 4.88% to end the day at R25.36. Other miners which came under pressure include Kumba Iron Ore [JSE:KIO] which lost 5.1% to R371.66, Glencore [JSE:GLN] which dropped 3.04% to close at R43.37, and Anglo American PLC [JSE:AGL] which lost 2.98% to close at R339.12. Listed property stock, Growthpoint Properties [JSE:GRT] weakened by 4.15% as it closed at R22.17, while Mediclinic [JSE:MEI] closed at R59.56 after falling 2.73%.

Grindrod [JSE:GND] managed to carve its name amongst the day’s biggest gainers after it advanced 7.58% to close at R4.97. Platinum miner, Anglo American Platinum [JSE:AMS] rose 6.35% as it close at R993.21, while Impala Platinum briefly surged above R100 before retracing to close 2.99% firmer at R99.90. DRD Gold [JSE:DRD] surged 4.86% to close at R7.34, while Sibanye Stillwater [JSE:SGL] gained 3.3% to close at R22.87. Equities Property Fund [JSE:EQU] added 2.1% to close at R20.86, Investec Australia Property Fund [JSE:IAP] gained 1.72% to close at R15.97, and Hyprop Investments [JSE:HYP] closed at R61.26 after gaining 1.63%.

The JSE All-Share index eventually closed 1.8% lower while the JSE Top-40 index lost 1.91%. All the major indices closed lower on the day. Resources dropped 2.11%, Industrials fell 2.19% and Financials lost 0.89%.

Brent crude slipped further in today’s session as it was recorded trading 1.9% weaker at $57.77/barrel just after the JSE close.

At 17.00 CAT, Palladium was up 2.28% at $1691.70/Oz, Platinum had gained 0.97% to trade at $885.85/Oz, and Gold was 1.1% firmer at $1495.65/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.