Global stocks surged on Thursday as trade war fears eased following the better than expected strengthening of the Chinese currency.

The Chinese yuan fell to a 3-year low earlier in the week which most market participants saw as a reactionary move to the increase in tariffs by the USA. This resulted in the US National Treasury classifying China as a currency manipulator, which sent global stocks tumbling lower. Volatility has been high in this week’s trading, and investors remain jittery over the possibility of another escalation which can easily be reignited.

Another volatile trading session ensued for the rand which fell to a session low of $15.20/$ after having peaked at a session high of R14.96/$ in earlier trading. The rand traded mostly weaker on the day before it was recorded trading 0.11% softer at R15.06/$ at 17.00 CAT.

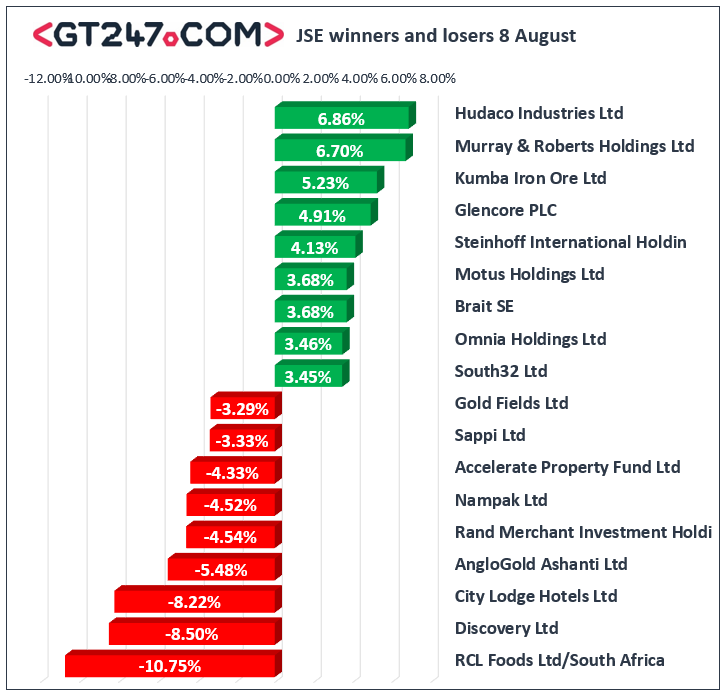

Blue-chip counters surged on the day with index heavyweight Naspers [JSE:NPN] climbing 2.37% to end the day at R3449.99. Mining giant BHP Group [JSE:BHP] gained 2.91% to close at R331.83, while its sector peer Anglo American PLC [JSE:AGL] managed to gain 2.9% to close at R339.05. Most of the general miners rebounded on the day which saw gains being recorded for Glencore [JSE:GLN] which gained 4.91% to close at R43.16, Exxaro Resources [JSE:EXX] which added 1.84% to close at R147.24, and Kumba Iron Ore [JSE:KIO] which advanced 5.23% to end the day at R431.07. Other significant gains on the day were recorded for Mondi PLC [JSE:MNP] which advanced 2.06% to close at R289.72, and Capitec Bank Holdings [JSE:CPI] which closed at R1107.00 after gaining 0.64%.

City Lodge Hotels [JSE:CLH] slumped in today’s session following the release of its full-year trading statement in which the company indicated that it is expecting a decline in earnings. The stock eventually closed 8.22% lower at R99.58. AngloGold Ashanti [JSE:ANG] came under pressure following the release of a relatively mixed set of half-year results. The stock closed 5.48% lower at R302.48. Discovery Ltd [JSE:DSY] fell dramatically in the afternoon session as it eventually closed the day 8.5% lower at R115.47. Gold Fields [JSE:GFI] also fell following the release of a weak half-year trading update which saw the stock drop 3.29% to close at R87.86. Other significant losses recorded on the day were for MTN Group [JSE:MTN] which lost 2.87% to close at R109.47, and Sibanye Stillwater [JSE:SGL] which dropped 2.71% to close at R20.08.

The blue-chip JSE Top-40 index closed 0.95% firmer while the broader JSE All-Share index added 0.74%. The Financials index was the only major index to close softer as it lost 0.88%. The Industrials and Resources indices added 0.95% and 1.56% respectively.

Brent crude recouped some of the prior session’s losses as it was recorded trading 2.1% firmer at $57.41/barrel just after the JSE close.

At 17.00 CAT, Palladium was up 1.15% to trade at $1435.05/Oz, Platinum had lost 0.49% to trade at $860.10/Oz, and Gold was 0.47% softer at $1494.30/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.