The JSE was softer in today’s session as it took a break from the recent rally that has seen the All-Share Index hit record highs over the past few trading sessions.

Most of the price action was mainly driven by Rand hedge stocks which retreated due to a slightly firmer Rand. The Rand firmed mainly on the back of a weaker US Dollar as well as better than expected South African Manufacturing Production data. Manufacturing Production year-on-year came in at 1.5% which was better than the estimated level of -0.1%, whilst the month-on-month number was recorded at 0.3% on the back of an estimate -0.1%. The Rand peaked to an intra-day high of R13.62 to the US Dollar and just after the JSE closed it was trading at R13.63/$.

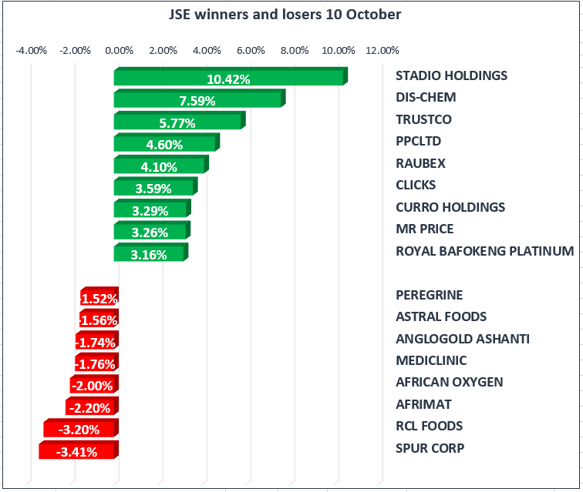

Retailers Mr Price [JSE:MRP] and Woolworths [JSE:WHL] were among the notable moves as they firmed by 3.26% and 1.87% respectively. Stadio [JSE:SDO] which starts trading ex-rights tomorrow had another stellar day as it gained 10.42%. Dis-Chem [JSE:DCP] also jumped on the back of a trading statement which indicated that they are expecting Earnings Per Share and Headline Earnings Per Share to be up by between 34.8% and 39.5% for the 6 months ended August 2017. The stock closed the day up 7.59% at R31.20 per share.

Famous Brands [JSE:FBR] came under significant pressure following the release of a trading statement for the 6 months ended 31 August after the JSE close yesterday. The statement indicated a significant loss from their UK subsidiary Gourmet Burger King (GBK), as well as increasingly difficult trading conditions in all the regions that they operate in. They indicated that they are expecting Headline Earnings Per Share to be down by between 54% and 63%, whilst Basic Earnings Per Share are expected to decrease by between 52% and 61%. Net finance costs for the group also increased for the period reported. The stock eventually closed down 10.74% at R105.50 per share.

The JSE All-Share Index eventually closed up 0.17% after having been under pressure for the better portion of today’s session, whilst the JSE Top-40 Index gained 0.08%. The Industrials Index firmed by 0.29% whilst the Financials Index climbed 0.78%. The Resources Index came under pressure to eventually close the day down 0.87%.

Gold gained on the back of the sliding US Dollar. The precious metal managed to record an intra-day high of $1294.31 per ounce which saw Gold Fields [JSE:GFI] gaining 0.33%. However AngloGold Ashanti [JSE:ANG] and Harmony Gold [JSE:HAR] traded under pressure to eventually close the day down 1.74% and 0.16% respectively. Gold was recorded at $1293.31 per ounce just after the JSE closed.

Palladium and Platinum both traded firmer today however JSE listed miners failed to gain much momentum on the back of that. Impala Platinum [JSE:IMP] closed down0.71%, whilst Sibanye Stillwater [JSE:SGL] managed to close 0.68% weaker. Platinum was trading at $914.74 per ounce just after the JSE close whilst Palladium was trading at $930.78 per ounce.

Brent Crude inched higher in today’s session as it broke above $56 per barrel to peak at $56.82 per barrel. However Sasol [JSE:SOL] failed to gain any momentum as it lost 1.08%. Brent Crude was trading at $56.68 per barrel just after the JSE closed.