The local bourse closed softer for a second consecutive session as miners extended their decline.

The Resources index has traded under considerable pressure with big declines being recorded for gold miners which have fallen on the back of a weaker gold metal price. Sector sentiment has seen general and platinum miners also tracking lower.

There was further disappointment in the manufacturing production numbers released by Statistics SA which highlighted more weakness in the South African economy. South Africa’s manufacturing production YoY for the month of July was recorded at -1.1% which was better than the consensus forecast of -1.8%. Manufacturing production MoM advanced 0.4% from a prior recording of -1.9%.

There were some positives on the currency market as the rand extended its gains against the greenback as it peaked at a session high of R14.65/$. At 17.00 CAT, it was trading 0.54% firmer at R14.67/$.

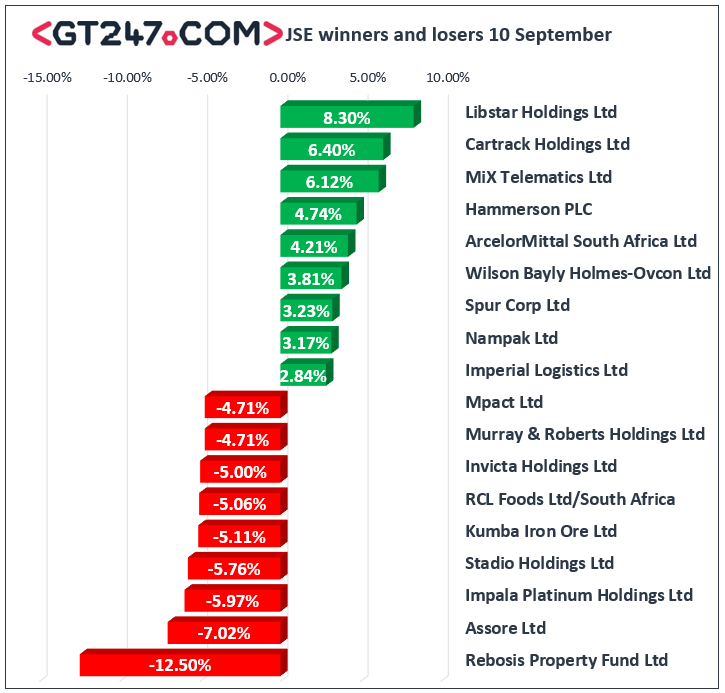

Losses amongst the miners were led by Assore [JSE:ASR] which fell 7.02% to end the day at R279.00 despite releasing a decent set of full-year results. Kumba Iron Ore [JSE:KIO] lost 5.11% to close at R391.55, Impala Platinum [JSE:IMP] dropped 5.97% to close at R81.05, and Anglo American Platinum [JSE:AMS] weakened to R839.81 after losing 3.66%. Multichoice Group [JSE:MCG] had another tough session which saw it drop 4.32% to close at R116.51. Other significant losses on the day were recorded for Northam Platinum [JSE:NHM] which lost 3.54% to close at R72.74, RCL Foods [JSE:RCL] which closed at R9.00 after losing 5.06%, and Murray & Roberts [JSE:MUR] which retreated by 4.71% to close at R12.75.

Libstar Holdings [JSE:LBR] stood out as one of the biggest gainers after it rallied 8.35 to close at R8.09. Listed property stock Hammerson PLC [JSE:HMN] gained 4.74% to close at R46.88 while its sector and geographical peer Intu Properties [JSE:ITU] advanced 2.74% to end the day at R7.50. Nampak [JSE:NPK] managed to record significant gains as it climbed 3.17% to close at R10.10, while Imperial Logistics [JSE:IPL] surged 2.84% to close at R53.59. Other significant losses on the day were recorded for British American Tobacco [JSE:BTI] which added 2.19% to close at R536.38, Discovery Ltd [JSE:DSY] which climbed 2.67% to R121.15, and commodity trading giant Glencore [JSE:GLN] which closed at R44.91 after gaining 1.45%.

The JSE All-Share index eventually closed 0.46% lower while the JSE Top-40 index shed 0.24%. All the major indices eventually closed softer with the Financials index barely closing softer as it lost 0.02%. The Industrials and Resources indices lost 0.47% and 0.39% respectively.

The optimism around OPEC’s output cuts extension saw brent crude extend its gains on the day as it was recorded trading 1.53% firmer at $63.55/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 1.17% to trade at $936.20/Oz, Gold was 0.24% softer at $1495.32/Oz, and Palladium had shed 0.76% to trade at $1557.85/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.