The JSE fell on Monday amid a flurry of global political and growth risks which continue to erode confidence from skeptic investors.

The reconvening of parliament in the United Kingdom further compounds the risk of Brexit, and in the USA an inquiry into the impeachment of Donald Trump was announced. These scenarios add more uncertainty to a global market which is struggling to come to terms with the impacts of the current trade war between China and the USA.

In Asia, the Hang Seng lost 1.28%, Shanghai Composite Index fell 0.77% while the Nikkei lost a more modest 0.36%. The major indices in Europe tracked mostly lower on the day while in the USA the Dow Jones was the only index to post gains at the open.

The rand took a tumble primarily on the back of US dollar strength. The local currency breached R15.00/$ as it peaked at a session low of R15.06/$, before it was recorded trading 0.92% lower at R14.99/$ at 17.00 CAT.

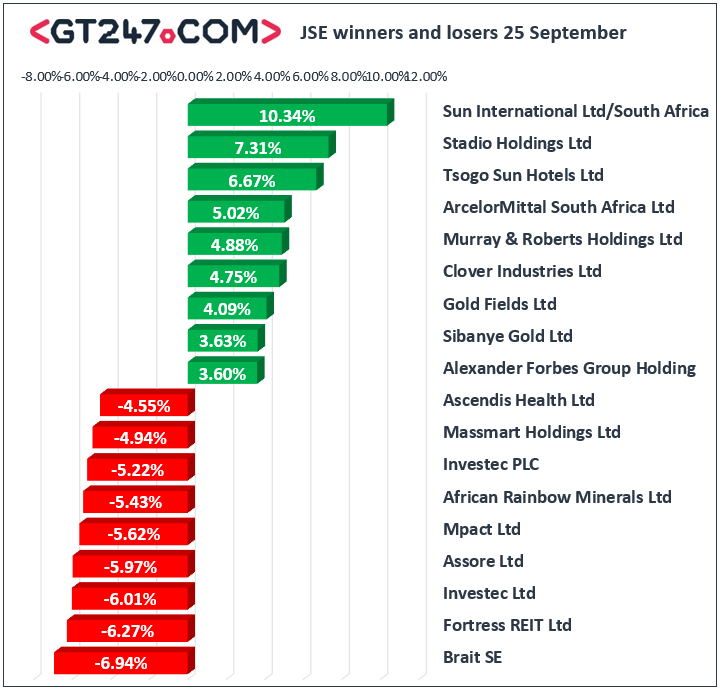

The weaker rand set out the tone for most of the moves on the local bourse as most rand sensitives retreated. Banker, Investec PLC [JSE:INP] lost 5.22% to close at R77.34, FirstRand [JSE:FSR] dropped 2.87% as it closed at R62.30, while ABSA Group [JSE:ABG] fell 2.84% to close at R157.01. Retailers also struggled on the day with losses being recorded for Shoprite [JSE:SHP] which lost 3.11% to close at R120.62, as well as Truworths [JSE:TRU] which closed at R53.64 after dropping 2.28%. Brait [JSE:BAT] gave back some of the prior session’s gains as it lost 6.94% to close at R15.96, while diversified miner African Rainbow Minerals [JSE:ARI] fell 5.43% to close at R142.89. Other significant losers on the day included Kumba Iron Ore [JSE:KIO] which lost 4.44% to close at R371.60, and Sasol [JSE:SOL] which closed at R268.00 after dropping 3.25%.

Hospitality stocks closed some of the day’s top gainers after gains were recorded for Sun International [JSE:SUI] which rose 10.34% to close at R48.32, as well as Tsogo Sun Hotels [JSE:TGO] which advanced 6.67% to close at R40.16. Gold mines recorded another session of gains as the rand-denominated price of gold was bolstered by the weaker rand. Gold Fields [JSE:GFI] advanced 4.09% to close at R81.20, Sibanye Stillwater [JSE:SGL] added 3.63% to close at R20.83, and AngloGold Ashanti [JSE:ANG] gained 2.185 to close at R312.31. Cigarette manufacturer British American Tobacco [JSE:BTI] managed to post gains of 1.64% to close at R540.70, while listed property stock Capital & Counties [JSE:CCO] advanced 2.56% to close at R42.00.

The JSE All-Share index lost 1.54% while the JSE Top-40 index fell 1.4%. All the major indices closed lower on the day with biggest losses being recorded for the Financials index which lost 2.13%. The Industrials and Resources indices lost 1.58% and 0.88% respectively.

At 17.00 CAT, Gold was down 0.93% to trade at $1517.98/Oz, Platinum had lost 1.95% to trade at $935.55/Oz, and Palladium was 1.82% lower at $1643.50/Oz.

Losses in brent crude extended as information broke out that production in Saudi Arabia was coming back online. It was recorded trading 1.66% weaker at $62.08/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.