The local bourse closed softer on Thursday on the back of broad-based losses across all the major indices.

Although the losses were modest, this weakness persisted for the duration of today’s session. This contrasted with the trend in global markets where stocks continued to ride the trade optimism which arose on Wednesday, on the back of hints that the USA would not hike tariffs on China at the next deadline of 15 December. Economic data out of South Africa, and more importantly GDP numbers were disappointing this week, which is also a factor which has added to the current pessimism on the local market.

The rand weakened against the greenback despite the US dollar trading softer against a basket of major currencies. The rand bottomed out at a session low of R14.69/$ before it was recorded trading 0.46% weaker at R14.65/$ at 17.00 CAT.

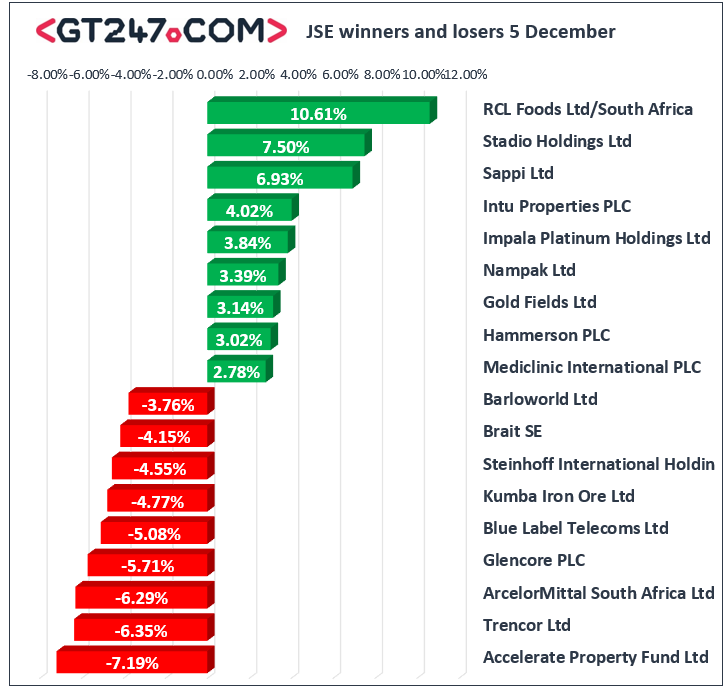

On the JSE, Glencore [JSE:GLN] grabbed headlines after it released a statement stating that the Serious Fraud Office had opened a investigation into suspicions of bribery in the conduct of its business. The stock quickly fell more than 7% to a session low of R42.36 before it settled 5.71% lower at R42.57 at the close. Brait [JSE:BAT] also struggled on the day as it lost 4.15% to close at R15.00, while Steinhoff International [JSE:SNH] lost 4.55% to close at R0.84. Kumba Iron Ore [JSE:KIO] gave up most of the prior session’s gains as it lost 4.77% to close at R385.50, while Exxaro Resources [JSE:EXX] dropped 1.27% to close at R131.82. Losses were also recorded for Barloworld [JSE:BAW] which fell 3.76% to close at R107.00, Woolworths [JSE:WHL] lost 2.02% to close at R48.59, and Naspers [JSE:NPN] which retreated 1.37% to close at R2036.77.

The volatility in RCL Foods [JSE:RCL] continued as the stock almost recouped all of Wednesday’s losses after the surged 10.61% to close at R10.53. Stadio Holdings [JSE:SDO] also recorded stellar gains on the day as it climbed 7.5% to close at R2.15, while Sappi [JSE:SAP] gained 6.93% to close at R41.06. UK focused property stock, Intu Properties [JSE:ITU] climbed 4.02% to close at R6.73, while its sector peer Hammerson PLC [JSE:HMN] gained 3.02% to close at R57.38. Platinum miner Impala Platinum [JSE:IMP] rose 3.84% to close at R127.20, while gold miner Gold Fields [JSE:GFI] added 3.14% to close at R87.46. Other significant gains on the day were recorded for Mediclinic [JSE:MEI] which rose 2.78% to close at R74.00, Discovery Ltd [JSE:DSY] which added 1.65% to close at R115.39, and Old Mutual [JSE:OMU] which closed at R18.60 after gaining 1.2%.

The JSE All-Share index eventually closed 0.23% softer while the blue-chip JSE Top-40 index shed 0.45%. The Resources index eked out some gains towards the close eventually closing 0.11% firmer. The Financials and Industrials indices lost 0.52% and 0.57% respectively.

Brent crude remained buoyant as it was recorded trading 0.65% firmer at $63.40/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.2% firmer at $1477.02/Oz, Platinum was 0.26% weaker at $893.05/Oz, and Palladium had shed 0.13% to trade at $1867.12/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.