The JSE closed weaker on Tuesday as stocks retreated from their mildly firmer close on Monday.

Rand hedge stocks benefitted from the weaker Rand which saw Mondi Ltd [JSE:MND] and Mondi PLC [JSE:MNP] gain 2.68% and 2.29% respectively. Sappi [JSE:SAP] and Richemont [JSE:CFR] also managed to firm by 1.64% and 0.79% respectively. Naspers [JSE:NPN] closed 1.3% firmer to close at R3078.71 per share but this was not enough to lift the blue-chip index.

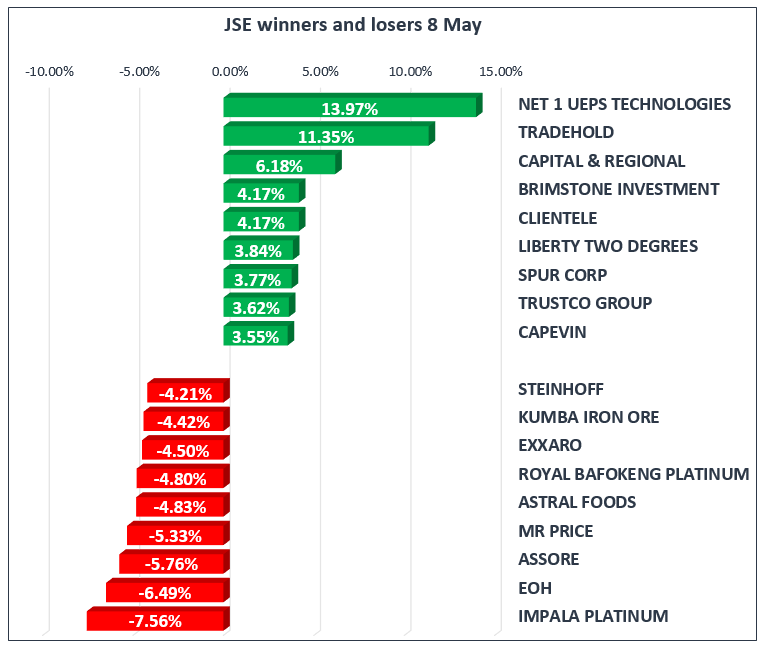

On the broader index Net 1 UEPS [JSE:NT1] and Clientele [JSE:CLI] jumped 13.97% and 4.17% respectively to end amongst the day’s biggest gainers. Rebosis Property Fund [JSE:REB] was buoyed by the release of its earnings results for the six months ended 28 February, which saw the stock closing gaining 3.13% to close at R8.25 per share. Balwin Properties [JSE:BWN] also managed to record gains of 1.69% to close at R6.00 per share.

On the day’s biggest losers, ArcelorMittal [JSE:ACL] came under significant pressure following the announcement about the resignation of its chief financial officer. The stock nose-dived to reach a session low of R2.11 per share before rebounding to eventually close at R2.42 per share, down 13.57% for the day. EOH Holdings [JSE:EOH] came under significant pressure to close 6.49% weaker at R36.00 per share.

Retailer, Mr Price [JSE:MRP] slid by 5.33% to close at R258.00 per share, whilst Impala Platinum [JSE:IMP] tumbled by 7.56% to close at R19.80 per share. Kumba Iron Ore [JSE:KIO] and Sibanye-Stillwater [JSE:SGL] lost 4.42% and 3.21% respectively, whilst Discovery [JSE:DSY] and MMI Holdings [JSE:MMI] shed by 2.80% and 2.21% respectively.

The blue-chip JSE Top-40 Index eventually closed 0.29% weaker, whilst the broader JSE All-Share Index lost 0.52%. There weren’t many positives to take note off as all the major indices closed in the red. The Financials Index lost 0.82%, whilst the Resources and Industrials Indices shed 0.51% and 0.08% respectively.

The US dollar strengthened significantly against a basket of major currencies as depicted by the US dollar index which climbed above 93 index points. The Rand declined to a session low of R12.63/$ and looked set for more weakness ahead of President Donald Trump’s decision on the Iran deal which is expected at 20.00 CAT. The Rand was trading at R12.62/$ at 17.00 CAT.

As a result of the US dollar strength Gold slid to a session low of $1306.14/Oz before it retraced briefly to trade at $1307.31/Oz at 17.00 CAT. Platinum was range-bound between $908/Oz and $914/Oz, and at 17.00 CAT it was trading at $909.40/Oz. Palladium slipped to a session low of $966.68/Oz earlier on but it managed to recoup those losses to trade at $971.80/Oz at 17.00 CAT.

Brent Crude traded softer to reach a session low of $75.17/barrel, as caution engulfed the market ahead of Donald Trump’s decision on Iran. The commodity was trading at $75.36/barrel just after the JSE close.