The JSE fell on Tuesday as it took a leaf from the Asian markets session where the major indices closed lower.

The Shanghai Composite Index came under significant pressure as it lost 1.68% while the Hang Seng lost 1.23%. The Japanese Nikkei was flat as it only added 0.06%. Stocks in Europe traded mostly flat on the day while in the USA the major indices opened marginally softer.

Investors continued to assess the potential impact from the disruption of oil supplies due to the attack on the Saudi Arabian pipeline. In addition to that, markets are tentative ahead of the US Fed’s interest rate decision which is expected to be announced on Thursday at 20.00 CAT. The Fed is forecasted to cut the interest rate by 25 basis points to 2.00%. Locally, the South African Reserve Bank is also expected to announce its interest rate decision on Thursday at 14.00 CAT, in which it is forecasted to keep the repo rate unchanged at 6.50%.

The rand lost ground against the greenback in today’s session as it slipped to a session low of R14.84/$ before it was recorded trading 0.48% weaker at R14.72/$ at 17.00 CAT.

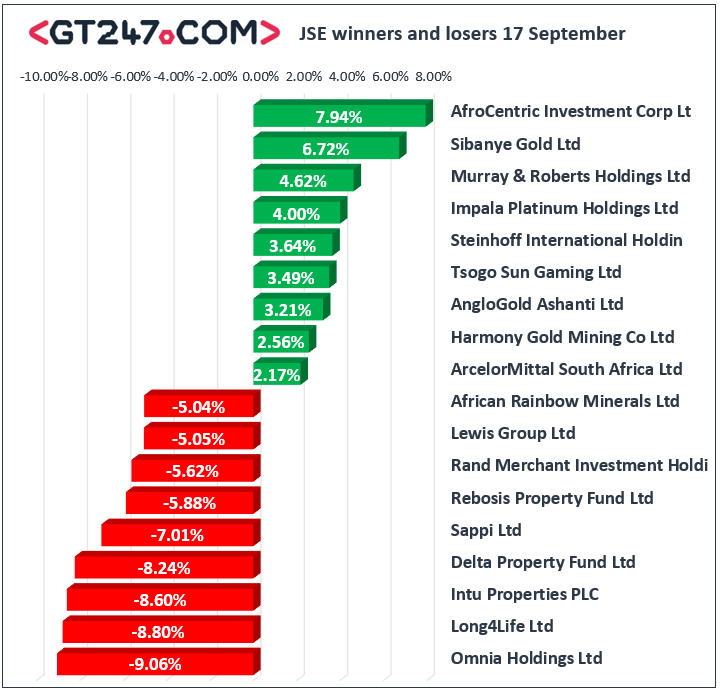

Listed property stocks came under significant pressure on the day. Intu Properties [JSE:ITU] closed amongst the day’s biggest losers after it tumbled 8.6% to close at R7.12, Delta Property Fund [JSE:DLT] fell 8.24% to close at R0.78, and Rebosis Property Fund [JSE:REB] lost 5.88% to end the day at R0.32. Rand hedge Sappi [JSE:SAP] tumbled 7.01% as it closed at R43.80, while oil and gas producer Sasol [JSE:SOL] gave back most of Monday’s gains to close 4.9% weaker at R291.00. Retailers also struggled on the day with losses being recorded for Shoprite [JSE:SHP] which lost 4.41% to close at R125.38, as well as Truworths [JSE:TRU] which fell 3.62% to end the day at R56.39. Financials also took significant losses with stocks such Standard Bank [JSE:SBK] falling 3.36% to close at R186.81, and ABSA Group [JSE:ABG] which closed at R167.24 after losing 2.8%.

Gold miners edged higher in today’s session led by gains from Sibanye Stillwater [JSE:SGL] which surged 6.72% to close at R17.62, AngloGold Ashanti [JSE:ANG] rallied 3.21% to close at R290.50, and Harmony Gold [JSE:HAR] gained 2.56% to close at R45.19. Platinum miner Impala Platinum [JSE:IMP] rallied 4% to close at R90.00, while British American Tobacco [JSE:BTI] gained 1.38% to close at R538.66. Other significant gainers on the day included Tsogo Sun Gaming [JSE:TSG] which added 3.49% to close at R14.25, as well as AB InBev [JSE:ANH] which closed at R1421.31 after gaining 1.64%.

The JSE All-Share index eventually closed 1.66% lower while the JSE Top-40 index lost 1.79%. the Financials index came under immense pressure as it fell 2.64%. The Resources and Industrials indices lost 0.7% and 1.83% respectively.

Brent crude prices tumbled following the announcement by OPEC that they would be able to resume full output sooner than expected. The commodity was trading 5.91% lower at $64.92/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.25% firmer at $1502.05/Oz, Platinum was 0.31% softer at $940.10/Oz, and Palladium was down 0.12% at $1604.10/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.