The JSE closed weaker on Thursday as it followed the trend lower in other global markets.

US markets came under pressure overnight after the US Fed kept interest rates unchanged. The central bank also indicated that they were satisfied with the current trajectory of inflation which has been a major cause of concern for the Fed over the past few years. The weakness recorded in the USA filtered onto Asian equity markets which traded mostly weaker.

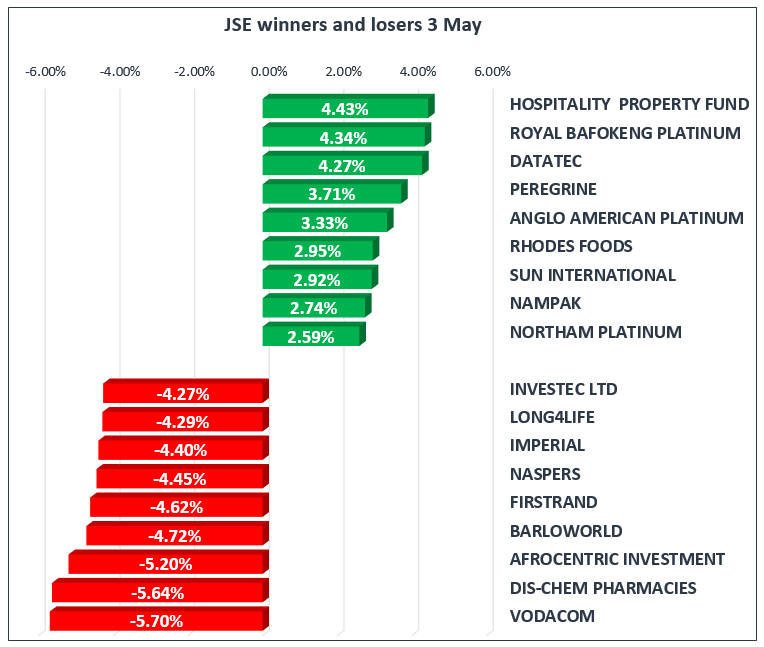

On the JSE, the local bourse opened lower and traded under pressure for the entirety of today’s session. Stadio Holdings [JSE:SDO] and Dis-Chem [JSE:DCP] closed among the day’s biggest losers after shedding 4.9% and 5.64% respectively. Barlowold [JSE:BAW] and Imperial Holdings [JSE:IPL] lost 4.72% and 4.4% respectively, whilst Resilient [JSE:RES] and Fortress B [JSE:FFB] slid further to lose 2.85% and 2.73% respectively.

Vodacom [JSE:VOD] and Naspers [JSE:NPN] anchored the bottom of the blue-chip index as they lost 5.7% and 4.45% respectively. Retailers, Mr Price [JSE:MRP] and Spar Group [JSE:SPP] closed 3.6% and 2.9% lower respectively, whilst banks such as First Rand [JSE:FSR] and Standard Bank [JSE:SBK] shed 4.62% and 3.09% respectively. Most the Top-40’s constituents were trading the red which aided in dragging the overall index lower.

A couple of stocks did close firmer with Hospitality Property Fund B [JSE:HPB] in particular, recording the biggest gain the day after it climbed 4.43%. Rhodes Food Group [JSE:RFG] gained 2.95% whilst platinum miners, Royal Bafokeng Platinum [JSE:RBP] and Northam Platinum [JSE:NHM] closed 4.07% and 2.59% firmer. Hospitality stocks, Sun International [JSE:SUI] and Tsogo Sun Holdings [JSE:TSH] recorded gains of 2.92% and 1.78% respectively.

Gold mining stocks, Harmony Gold [JSE:HAR] and Gold Fields [JSE:GFI] were buoyed by firmer Gold metal prices but gains were limited due to the stronger Rand. The stocks closed the day 2.01% and 0.38% firmer respectively. MTN [JSE:MTN] was the biggest gainer on the blue-chip index after recording gains of 1.13%.

The local index came under more pressure following the opening of US markets this afternoon, and this saw the JSE All-Share Index closing 2.01% weaker, whilst the JSE Top-40 Index lost 2.22%. All the major indices traded under significant pressure with the biggest losers being the Financials Index which lost 2.85%, whilst the Industrials and Resources Indices lost 2.38% and 0.71% respectively.

Another volatile trading session ensued for the Rand as it managed to strengthen to a session high of R12.56/$. However the local currency erased all of its gains to trade at R12.72/$ at 17.00 CAT.

Gold was buoyed by a softer US dollar which saw the precious metal reach an intra-day high of $1318.17/Oz. At 17.00 CAT it had retraced to trade at $1313.62/Oz. up 0.67% for the day. Platinum climbed back above $900/Oz to trade at $901.52/Oz at 17.00 CAT, whilst Palladium was also trading firmer to be recorded at $966.25/Oz at 17.00 CAT.

Brent Crude traded mostly softer to be recorded at $72.94/barrel just after the JSE close.