The JSE closed firmer on Thursday as it shrugged off news that Chinese officials are casting doubts about reaching a comprehensive long-term trade deal with the USA.

This contrasted with the trend in Europe and the USA were stocks retreated on the back of these news. The local bourse seemed to take a leaf from the Nikkei and the Hang Seng which closed 0.37% and 0.9% higher respectively. The drop in global stocks was also compounded by the release of weaker than expected manufacturing and non-manufacturing PMI data out of China.

Investors now shift their attention to Caixin’s release of Chinese manufacturing PMI data which is expected on Friday. Focus will also be on the USA for the release of the all-important non-farm payrolls numbers as well as its ISM manufacturing PMI numbers.

Locally, Statistics SA released producer inflation data for the month of September. PPI YoY fell to 4.1% from a prior recording of 4.5%. while PPI MoM was recorded at 0.2% which was lower than the prior recorded level of 0.3%.

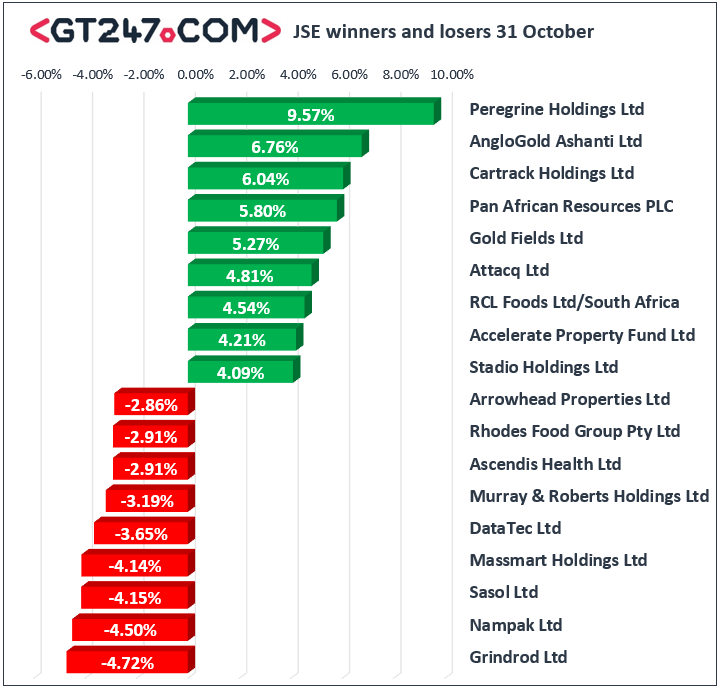

On the JSE, miners recorded most of the day’s gains. Gold miner AngloGold Ashanti [JSE:ANG] surged 7.37% to close at R330.39 as it finished the session amongst the day’s biggest advancers. Pan African Resources [JSE:PAN] rallied 7.14% as it closed at R2.40, Anglo American Platinum [JSE:AMS] gained 2.52% to close at R1127.68, while Gold Fields [JSE:GFI] advanced 5.7% to close at R92.94. Sibanye Gold [JSE:SGL] was also buoyed by the release of a positive quarterly operational update which saw the stock gain 4.11% to close at R29.15. Rand hedge, Mondi PLC [JSE:MNP] gained 2.67% to end the day at R312.50, while Sappi [JSE:SAP] climbed 4.02% to close at R38.80. Other significant risers on the day included Shoprite [JSE:SHP] which rose 2.28% to close at R135.41, and Multichoice Group [JSE:MCG] which closed at R126.03 after gaining 2.05%.

Nampak [JSE:NPK] continued on its downward trend as it lost 4.97% in today’s session to close at R8.03. Grindrod Ltd [JSE:GND] also struggled on the day eventually closing 4.91% weaker at R4.84. Oil and gas producer Sasol [JSE:SOL] came under pressure as it fell 4.5% to end the day at R274.27, while coal miner Exxaro Resources [JSE:EXX] lost 2.75% to close at R123.31. Diversified miner South32 [JSE:S32] dropped 2.34% to close at R26.28, while African Rainbow Minerals [JSE:ARI] lost 1.81% to close at R151.20. Other losers on the day included Redefine Properties [JSE:RDF] which closed at R7.54 after falling 0.79%, as well as Massmart [JSE:MSM] which dropped 3.38% to end the day at R42.90.

The JSE All-Share index eventually closed 1.25% higher while the JSE Top-40 index managed to gain 1.4%. All the major indices advanced on the day with the biggest gainer being the Resources index which gained 1.6%. The Industrials and Financials indices gained 1.49% and 0.48% respectively.

The rand extended its declines primarily on the back of the budget speech which was read on Wednesday. The rand was trading 0.8% weaker at R15.11/$ at 17.00 CAT.

Brent crude slipped on the back of trade war fears as well as increasing global stockpiles. The commodity was trading 1.61% weaker at $59.27/barrel.

At 17.00 CAT, Palladium was 0.69% softer at $1795.55/Oz, Platinum was up 0.37% at $929.00/Oz, and Gold had gained 1.03% to trade at $1511.19/oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.