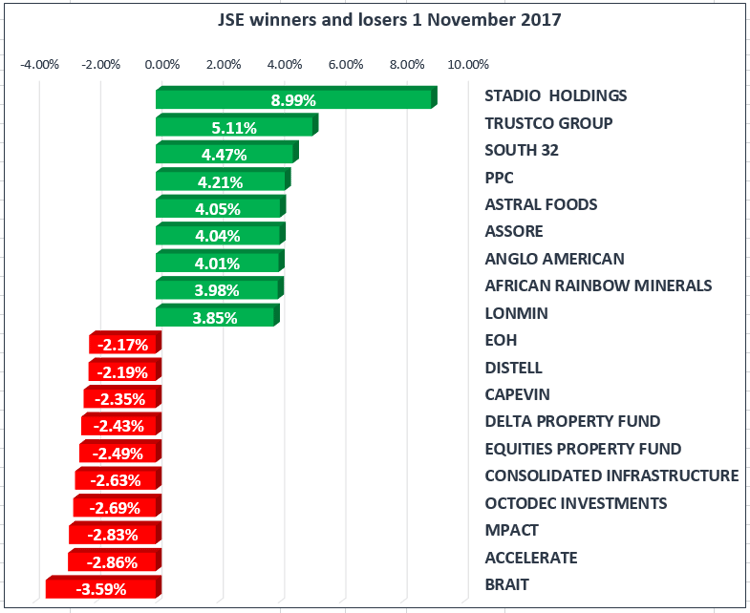

The JSE tracked higher, following positive global markets, supported by a weaker rand for most of the day.

The rand firmed to R14.06/$ near the end of the trading session, after sitting near R14.12 for most of the day. The late strength came from dollar weakness at the open of US markets at 15:30 locally.

Local markets were driven by resources and industrial stocks, with the large dual listed businesses gaining on the back of offshore market optimism. The price of Brent crude touched $61.62 per barrel for first time in more than two years, boosting shares such as Sasol and BHP, before cooling off to $60.62 at the close of the market.

BHP Billiton gained 3.03% to R263 per share while Sasol climbed 2.01% to R422 per share.

The JSE All-Share Index closed the day 0.91% firmer, matched by the blue-chip JSE Top-40 Index gaining 0.93%.

Old Mutual traded 1.01% higher and closed at R36.02 after announcing earlier in the day that it was cutting its interest in Nedbank to 19.9%, from 54%.

Gold appeared to temporarily halt its slide and found a short-term support near $1276/Oz Gold has been on a steady decline since early September when the safe haven asset traded above $1340/Oz, given recent turmoil in the geopolitical landscape, with major events occurring like the threat of a nuclear war, Brexit, and a European split up, and the likes, the question is why safe havens are not reacting stronger.

House Republicans spent all day Tuesday trying to iron out last-minute disagreements on their tax reform proposal, but with a number of issues still unresolved, a bill is now expected to be released Thursday. Some details are already starting to leak out that indicate that they intent to lower the corporate tax rate to 20%, keep the current top 39.6% tax rate on the wealthiest individuals and delay a planned repeal of the estate tax.

The Fed is expected to keep interest rates unchanged today as speculation swirls on who will be its next leader. With no updated economic projections or a press conference by Janet Yellen, investors will look to any change in the statement language for confirmation of a December rate hike. The Fed has already raised rates twice since January, and currently forecasts one more increase by the end of the year.

Bitcoin has smashed through the $6,500 barrier to hit a new record level after the CME announced plans to launch bitcoin futures later this year. Prices hit a high of $6,550, according to CoinDesk, resulting in a bitcoin market capitalization of $109B. The introduction of such a product could bring more institutional investors into the market, boosting bets the cryptocurrency could enter the financial mainstream. Returns on the cryptocurrency are in excess of 500% for 2017, with many commentators warning of an asset bubble.