The JSE rose on Friday primarily on the back of gains recorded on the mining index as well as advances from all the major indices.

The local bourse took a leaf from trading in Asia where stocks rallied on the back of more solid bets for a US Fed rate cut at the next policy meeting. There are now arguments suggesting that the Fed could actually tussle between deciding to cut rates by either 25 or 50 basis points, However the Fed fund futures index does indicate that market participants are currently pricing in a 25-basis points rate cut.

In mainland China the Shanghai Composite Index rallied 1.05%, while in Hong Kong the Hang Seng managed to rise 1.07%. In Tokyo the Japanese the Nikkei closed 2% higher. Gains were fairly modest in across the major European bourses while in the USA markets managed to open firmer.

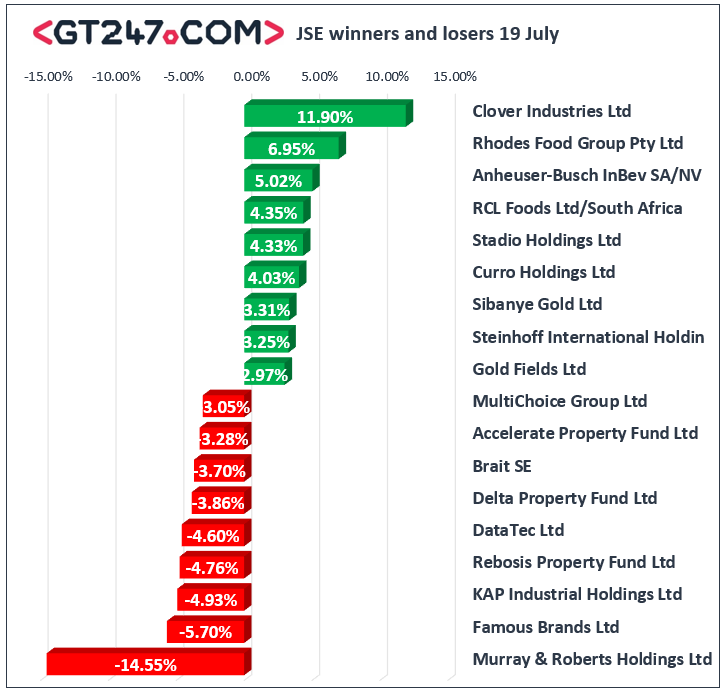

On the JSE, Pioneer Foods Group [JSE:PFG] rocketed on the back of the news that Pepsi Co had agreed to buy the company for about R110 per share which is a significant premium to where it is currently trading. The stock climbed 32.09% to end the day at R102.50. Pioneer’s biggest shareholder Zeder Investments [JSE:ZED] surged 23.17% to close at R4.89 as it is expected to vote in favour of the buyout. Anheuser-Busch InBev [JSE:ANH] was buoyed by news that the company had agreed to sell Carlton and United Breweries to Asahi Group. The share eventually closed the day 5.02% higher at R1296.56.

Miners traded mostly firmer on the day with significant gains being recorded for Sibanye Stillwater [JSE:SGL] which climbed 3.31% to close at R18.09, Gold Fields [JSE:GFI] surged 2.97% to close at R78.10, and diversified mining giant Anglo American PLC [JSE:AGL] closed at R388.82 after gaining 2.6%. Other material gainers on the day included RCL Foods [JSE:RCL] which advanced 4.35% to close at R12.00, as well as Massmart [JSE:MSM] which gained 2.89% to close at R64.50.

Murray and Roberts [JSE:MUR] tumbled 14.55% to close at R11.80 following news that the Competition Tribunal had been advised to reject ATON’s proposed buyout of Murray and Roberts [MUR]. Delta Property Fund [JSE:DLT] came under pressure on the day as it lost 3.86% to close at R1.99, while Rebosis Property Fund [JSE:REB] weakened by 4.76% to end the day at R0.60. PPC Limited [JSE:PPC] retreated mainly on the back of its full-year results which showed a decline in basic earnings per share. The stock lost 2.91% to end the day at R5.00. Other significant losers on the day included KAP Industrial Holdings [JSE:KAP] which lost 4.93% to close R5.40, and Multichoice Group [JSE:MCG] which shed 3.05% to close at R132.45.

The JSE Top-40 index managed to add 0.72% while the broader JSE All-Share index firmed 0.4%. All the major indices managed to advance in today’s session. The Resources index was the biggest gainer as it added 1.25%, while the Financials and Industrials indices rose 0.4% and 0.29% respectively.

The rand had a mixed session as it peaked at a session high of R13.81/$ before retracing to trade 0.56% weaker at R13.91/$ at 17.00 CAT.

Brent crude remained relatively muted in today’s session before it was recorded trading 0.34% firmer at $62.13/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 0.28% to trade at $849.85/Oz, Palladium was trading 1.41% weaker at $1507.80/Oz, and Gold had lost 1.27% to trade at $1427.91/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.