The JSE reversed earlier losses as it advanced to close firmer on Wednesday on the backdrop of improved South African retail sales data for the month of November.

Retail sales YoY advanced 2.6% from a prior recording of 0.4%, while retail sales MoM rose 3.1% from a prior recording of 0.1%. The rand did gain some momentum in the afternoon session after the data release. The local unit rose to a session high of R14.33/$ before it was recorded trading 0.34% firmer at R14.34/$ at 17.00 CAT.

Global markets tracked mostly lower on the day despite market participants anticipating that the phase one trade deal between China and the USA was going to be signed later today. With no timeline set on the commencement of the next round of talks and this being a US election year, there are concerns that another protracted back and forth could continue before another agreement is reached.

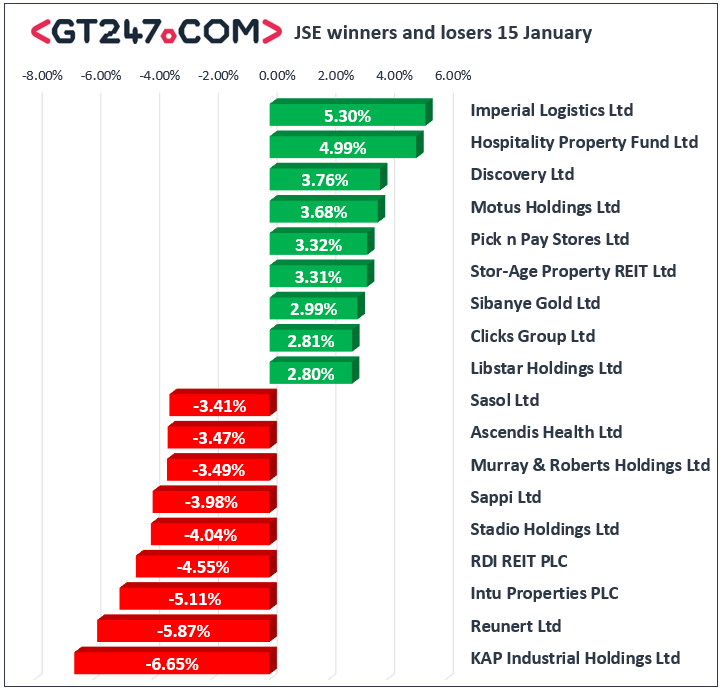

On the JSE, retailers found some momentum on the back of the positive retail sales data release. Pick n Pay [JSE:PIK] gained 3.32% to close at R65.71, Truworths [JSE:TRU] added 1.69% to close at R48.10, while The Foschini Group [JSE:TFG] rose 1.86% to close at R155.26. Imperial Logistics [JSE:IPL] closed amongst the day’s biggest gainers after it advanced 5.3% to close at R58.99, while Motus Holdings [JSE:MTH] gained 3.68% to close at R83.47. Luxury goods retailer Richemont [JSE:CFR] firmed 1.97% to close at R115.42, while index heavyweight Naspers [JSE:NPN] closed at R2450.00 after gaining 0.98%. Other significant gains on the day were recorded for RMB Holdings [JSE:RMH] which advanced 1.45% to close at R78.86, as well as Sibanye Gold [JSE:SGL] which closed 2.99% higher at R35.84.

Reunert [JSE:RLO] came under significant pressure on the day as it slid 5.87% to close at R65.05, while KAP Industrial Holdings [JSE:KAP] tumbled 6.65% to close at R3.93. Intu Properties [JSE:ITU] retreated 5.11% as it closed at R4.46, its industry peer Hammerson PLC [JSE:HMN] dropped 3.07% to close at R49.58. Oil and gas producer, Sasol [JSE:SOL] continued to reel as it lost another 3.41% to close at R290.75.Rand hedge, Sappi [JSE:SAP] weakened by 3.98% to close at R41.05, while Woolworths [JSE:WHL] bucked the trend in other retailers as it lost 1.49% to close at R51.42. Losses were also recorded for REDI REIT [JSE:RPL] which lost 4.55% to close at R24.10, and Kumba Iron Ore [JSE:KIO] which closed at R404.41 after losing 2.01%.

The JSE All-Share index closed 0.17% firmer while the JSE Top-40 index managed to gain 0.2%. The Resources index was the only major index to come under pressure as it lost 0.81%. The Industrials and Financials indices gained 0.8% and 0.48% respectively.

Brent crude remains range bound in the $64/barrel range. The commodity was recorded trading 0.42% weaker at $64.19/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.21% firmer at $1549.43/Oz, Palladium was up 2.92% at $2257.35/Oz, and Platinum had surged 3.82% to trade at $1020.90/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.