The local bourse started the week on the slide as it closed weaker mainly due to subdued global sentiment.

Investors continued to assess the impact of the coronavirus particularly to global growth with most sectors taking a rather cautious approach. There are still broader concerns over the spread of the virus and how prepared health authorities are to contain it. However, it seems investors are shifting their focus to primary economic indicators in order to gauge the extent of the impact.

Locally there were no economic data releases, therefore the local bourse tracked mostly lower in line with global markets. The rand which weakened significantly over the past week remained mostly subdued in today’s session. The local currency found some momentum earlier as it peaked at a session high of R14.97/$ before it was recorded trading 0.21% firmer at R15.02/$.

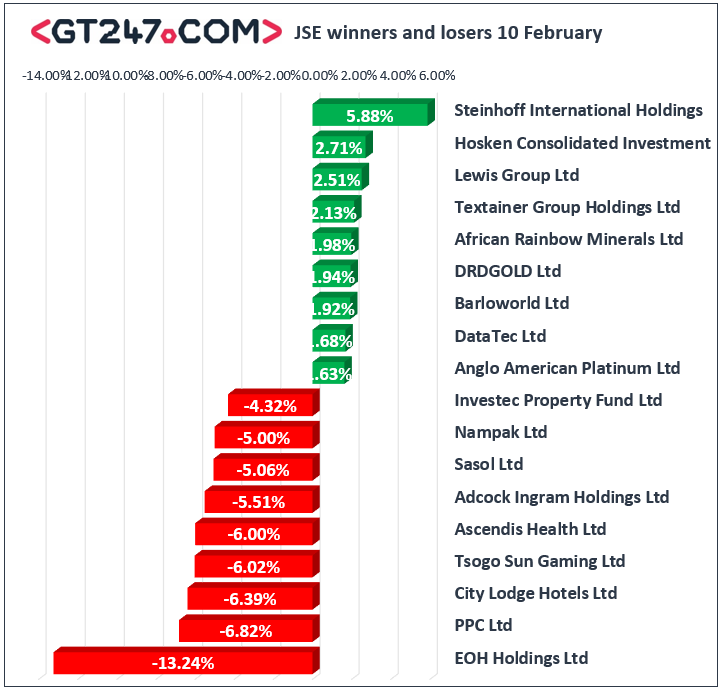

On the JSE, EOH Holdings [JSE:EOH] came considerable pressure as it tumbled 13.24% to close at R5.11. [Read more on EOH here] PPC Ltd [JSE:PPC] also struggled on the day as it lost 6.82% to close at R2.05, while Murray & Roberts [JSE:MUR] dropped 4.25% to close at R10.60. Oil and gas producer, Sasol [JSE:SOL] retreated 5.06% to close at R222.17, while coal miner Exxaro Resources [JSE:EXX] fell 2.01% to close at R117.74. Mining giant Anglo American PLC [JSE:AGL] weakened by 0.78% to close at R392.79, while its sector peer BHP Group [JSE:BHP] closed at R320.78 after losing 1.67%. Losses were also recorded for Sappi Ltd [JSE:SAP] which lost 3.51% to close at R32.40, Shoprite [JSE:SHP] which fell 2.62% to close at R116.86, and Imperial Logistics [JSE:IPL] which closed at R48.90 after losing 1.71%.

Intu Properties [JSE:ITU] was buoyed by the release of a statement in which the firm indicated that it is in discussions with key stakeholders in relation to a proposed equity raise. The share rocketed 24.03% to close at R3.20. Northam Platinum [JSE:NHM] surged on the back of the release of a positive half-year trading update which saw the stock gain 1.6% to close at R43.85. Other platinum miners also advanced on the day with gains being recorded for Anglo American Platinum [JSE:AMS] which rose 1.63% to close at R1198.81, and Impala Platinum [JSE:IMP] which added a more modest 0.85% to close at R148.00. Gains were also recorded for Kumba Iron Ore [JSE:KIO] which gained 1.35% to close at R341.05, and Mediclinic [JSE:MEI] which closed at R75.55 after losing 1.33%.

The JSE All-Share index closed 0.75% lower while the blue-chip JSE Top-40 index lost 0.76%. All the major indices closed weaker on the day. Industrials lost 0.49%, Financials weakened by 0.7% while the Resources index fell 1.27%.

At 17.00 CAT, Platinum was down 0.82% at $956.85/Oz, Gold was 0.15% firmer at $1572.30/Oz, and Palladium had surged 1.17% to trade at $2342.37/Oz.

Brent crude remained subdued as it was recorded trading 0.97% weaker at $53.95/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.