The local bourse resumed its downtrend to close lower on Wednesday as the concerns surrounding the trade war remained aloof.

The relief recorded across most of the major global indices in the prior session seemed to have been short lived, as pressure mounted across most of the indices except for Asia where markets traded mostly firmer. Locally, investors eagerly awaited quarterly earnings results from Tencent Holdings in which Naspers [JSE:NPN] holds a significant shareholding. Tencent Holdings recorded its slowest pace of sales growth since listing which led to pressure on the Johannesburg listed Naspers, which dragged the All-Share index lower due to its large weighting on the JSE.

In terms of economic data, Statistics SA released South Africa’s retail sales data for the month of March. Retail sales MoM fell 0.7% from a prior recording of 0.6%, while retail sales YoY only managed to expand by 0.2% from a prior recording of 1.1%. The rand traded mostly flat as it was range bound between R14.20/$ and R14.30/$. At 17.00 CAT, the rand was trading 0.16% firmer at R14.21/$.

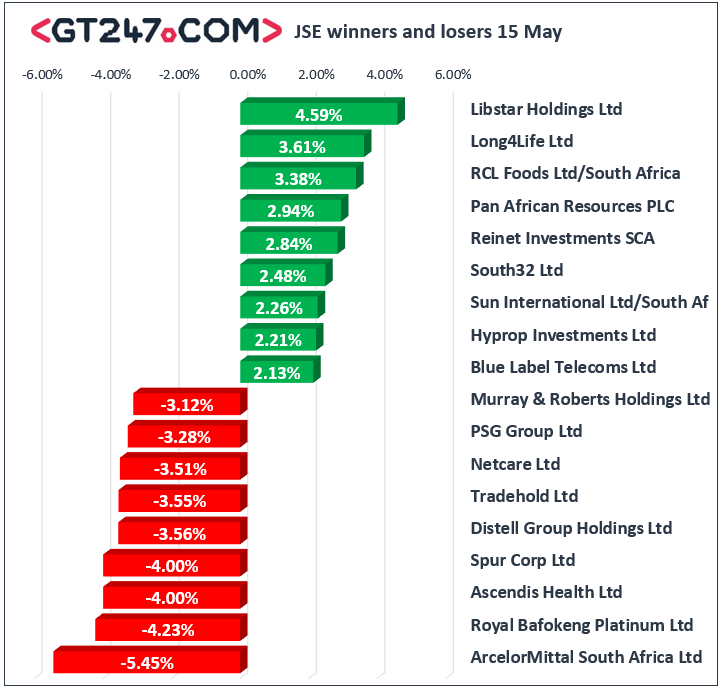

Naspers [JSE:NPN] led losses on the JSE as it fell 1.08% to close at R3314.00 following the release of Tencent Holdings’ quarterly results. Netcare [JSE:NTC] also came under significant pressure as it lost 3.51% to close at R20.87, while Tsogo Sun Holdings [JSE:TSH] dropped 2.83 to close at R21.64 Oil and gas producer Sasol [JSE:SOL] retreated to close 1.73% weaker at R433.43, while listed property stock Investec Property Fund [JSE:IPF] lost 2.31% to end the day at R15.23. Retailers remained under pressure as losses were recorded for Mr Price [JSE:MRP] which lost 2.7% to close at R205.31, Truworths [JSE:TRU] which dropped 1.73% to close at R71.94, and Woolworths [JSE:WHL] which closed at R47.30 after dropping 1.23%.

Gains were recorded for Libstar Holdings [JSE:LBR] which managed to post gains of 4.59% as it closed at R8.65, as well as Long4Life [JSE:L4L] which climbed 3.61% to close at R4.88. Reinet Investments [JSE:RNI] posted gains of 2.84% as it finished at R230.74, while Zeder Investments [JSE:ZED] inched up 0.7% to close at R4.30. Gold miners gained some momentum as they ended the day firmer. AngloGold Ashanti [JSE:ANG] gained 2.13% to close at R169.27, while Gold Fields [JSE:GFI] added 1.83% to close at R53.97. Coal miner Exxaro Resources [JSE:EXX] gained 1.45% to close at R154.92, while Anglo American Platinum [JSE:AMS] rose 1.27% to end the day at R710.24.

The JSE All-Share index eventually closed 0.34% weaker while the JSE Top-40 index lost 0.4%. Weakness persisted across all the major indices with the exception of the Resources index which eked out gains of 0.09%, while the Industrials and Financials lost 0.43% and 0.72% respectively.

Brent crude recovered from its overnight slump to trade mostly firmer on the day. The commodity was trading 0.65% firmer at $71.67/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.07% weaker at $1296.08/Oz, Platinum was 1.36% weaker at $844.10/Oz, and Palladium was down 0.25% at $1335.25/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.