Local

JSE eases as investors take profit after the biggest one-day rally in three years, the All-Share consolidated down 0.69%, with the blue-chip Top40, down 0.86%, financials down, 1.18% and industrials down, 0.56%.

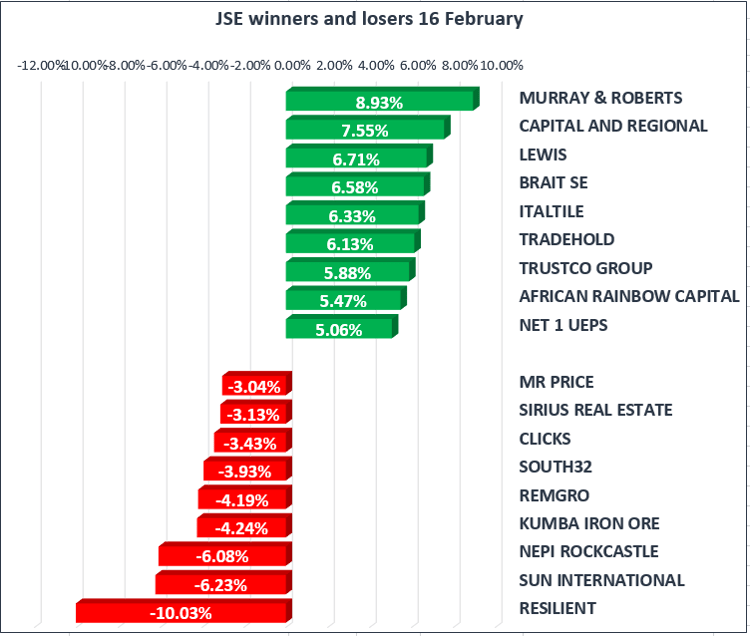

A mixed day for retail stocks as Lewis [JSE:LEW] and Italtile [JSE:ITE] closed higher, up 6.71% and 6.33% respectively, while Mr Price [JSE:MRP] and Clicks [JSE:CLS] shed 3.0% and 3.43% on the day.

Other noticeable moves saw Murray & Roberts Holdings [JSE:MUR], climbed up 8.93%, while Kumba Iron Ore [JSE:KIO], once a market favourite, dropped by 4.24%.

Resilient [JSE:RES] and Nepi Rockcastle [JSE:NRP] pain continued, as they ended the week lower, down another 10.03% and 6.08%.

The local currency was trading cautiously, ahead of newly elected President, Cyril Ramaphosa’s state of the nation address tonight and next week’s budget speech. We saw the rand trading at R11.66 to the dollar, R16.38 to the pound and R14.54 to the euro.

Commodities

Commodity prices traded mixed on the day, as the U.S. dollar index rebounded from a three-year low earlier in the session off the back of strong U.S. housing data.

Gold was trading higher at $1356.96 per ounce, silver at $16.82 per troy ounce and platinum trading at $1007.66 per troy ounce.

Oil prices stabilised on Friday, as expectations for further efforts to limit global supply continued to offer support at these levels, offsetting concerns about rising U.S. crude production.

Brent Crude is currently trading at $64.83/bbl and WTI trading at $61.25/bbl.

Global Stocks

A quiet day for Asian equities as most markets were closed for the Lunar New Year holiday, Japan’s Nikkei was up 1.19% on the day, and 1.58% for the week, after Haruhiko Kuroda was nominated to lead the Bank of Japan for another five-year term.

Elsewhere, European markets continued to rally as investor confidence rose amid strong earnings, the DAX was higher by 0.82%, the CAC-40 by 1.04% and the FTSE by 0.86% at the time of writing.

U.S. stocks opened mixed, before edging higher as the Dow, S&P 500 and Nasdaq tried to record their best weekly gain in five-years, rebounding sharply from the correction levels seen last week.

Cryptocurrencies

Bitcoin climbed above $10,000 in intraday trade, as regulatory fears faded after South Korean officials seemed to pivot towards a more ‘friendly’ regulatory approach of the crypto industry.

Bitcoin is currently trading at $10,052, up 2.20%, while, Ethereum, was down roughly 0.47% trading at $933.