The JSE remained under pressure on Tuesday, in line with Asian markets. The strengthening rand supported banking stocks, whilst hurting offshore based industrial stocks.

The rand firmed to R13.68 to the dollar as the local bond market benefitted from an inflow of offshore money, increasing the price of local bonds and supporesing the yield.

Following the S&P and Moody’s ratings verdicts, banks prices have rallied. However, banks remain vulnerable to economic difficulties, movements in bond yields, and problematic politics. Bond yields remain more attractive in the short term, as noted by the increased holdings by foreigners.

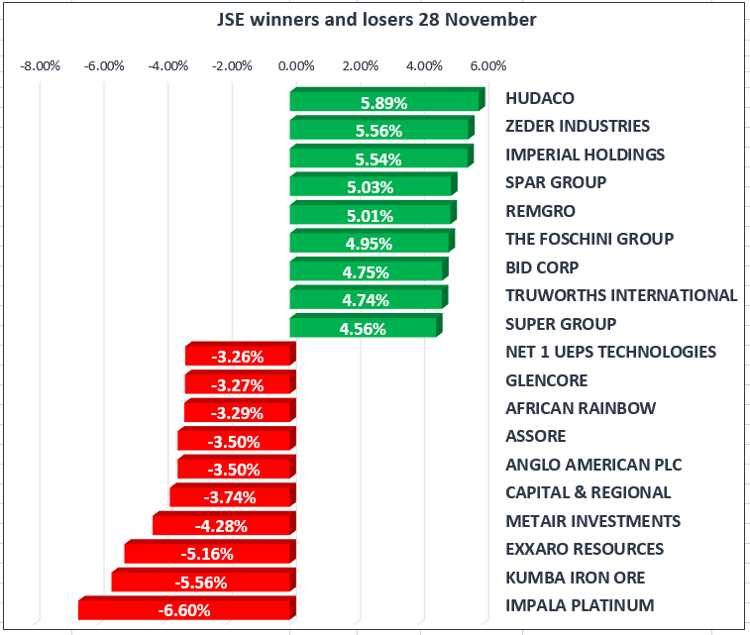

The All-Share index edged 0.12% lower, while the blue-chip Top40 fell 0.31% as the index boasts a higher weighting of large insdustrial companies. Financials remained positive, gaining 1% along with the gold miners which picked up 0.44% whilst resources fell 2.08%

Naspers shed 0.36% to R3‚780. The group will announce its interim results on Wednesday.

Hudaco [JSE:HDC] gained 5.89% to R131.28, the business has attracted increased interest over the last few years after making several significant acquitisions to diversify away from its heavy expsoure to mining and manufacturing.

Banking stocks are particularly sensitive to fluctuations in long bond yields, with which banks have an inverse relationship. As the rate on long dated bonds increases, the share prices of banks fall.

Barclays Africa [JSE:BGA] led the banking sector higher on Tuesday, gaining +2.77% to R158.20, followed by Nedbank [JSE:NED] advancing +2.54% to R224.04, Firstrand [JSE:FSR] +1.75% to R55.99 and Standard Bank [JSE:SBK] +1.71% to R174.35.

The share prices of the big four banks have been largely range bound but could be vulnerable to further political shocks and external factors, including foreign shareholders and bond investors heading for the hills, should the political situation worsen.

Market rallies are an opportunity to take money off the table from a trading point of view, Or as market analyst Mark Ingham mentioned “Keep your powder dry, bank small gains and take small losses on the chin in a market where sentiment is brittle”

Brent Crude remains strong at $63.56/bbl, with no ease in sight on fuel prices, keeping inflation risk to the upside.

Gold prices have ticked higher over the last week, with the precious metal trading at $1295/Oz at the close of the market.