The local bourse closed firmer on Tuesday as it tracked other global markets higher.

The sea-saw action in financial markets continues despite the ongoing risks associated with the coronavirus. The gains in today’s session seem to have been triggered by another record high trading session in the USA on Monday.

On the local market more attention was on the release of 4th quarter unemployment rate numbers by Statistics SA. The unemployment rate for the 4th quarter was recorded at 29.1% which was unchanged from the prior recording. Manufacturing production numbers for the month of December also disappointed as YoY they were recorded at -5.9% from a prior recording of -3.2%. Manufacturing production MoM was recorded at -2.8% from a prior recording of -1.8%.

Despite the weaker economic data, the rand held on to its gains as it reached a session high of R14.85/$. At 17.00 CAT, the rand was trading 0.5% firmer at R14.87/$.

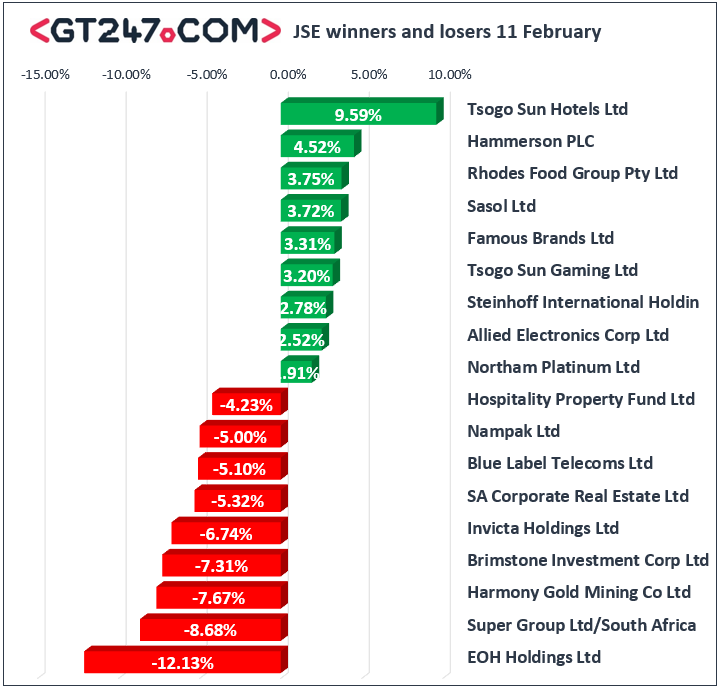

On the local bourse, Tsogo Sun Hotels [JSE:TGO] found some momentum towards the close as it rallied 9.59% to close at R4.00, while Tsogo Sun Gaming [JSE:TSG] advanced 3.2% to close at R10.63. Index giant Naspers [JSE:NPN] gained 1.44% to close at R2643.00, while Prosus [JSE:PRX] rose 1.5% to close at R1144.44. Listed property stock Hammerson PLC [JSE:HMN] advanced 4.52% to close at R45.83, while Fortress REIT [JSE:FFB] added 1.68% to close at R6.66. Sasol [JSE:SOL] found a reprieve in today’s session as it rallied 3.72% to close at R230.44. Rand hedge, Mondi PLC [JSE:MNP] posted gains of 1.24% to close at R325.05, while Bid Corporation [JSE:BID] closed 1.03% firmer at R324.50. Significant gains were also recorded for Sibanye Gold [JSE:SGL] which advanced 1.53% to close at R37.83, as well as Woolworths [JSE:WHL] closed at R44.15 after rising 1.1%.

Intu Properties [JSE:ITU] released a follow up statement to the one released on Monday, stating that Linked Real Estate Investment Trust was no longer participating in the recapitalization of the company. The share plummeted 32.81% to close at R2.15. Harmony Gold [JSE:HAR] came under pressure despite reporting an increase in earnings for the interim period ending 31 December 2019. The share closed 5.74% lower to close at R42.67. Declines were also recorded for other gold miners such as AngloGold Ashanti [JSE:ANG] which lost 2.94% to close at R286.01, as well as Gold Fields [JSE:GFI] which dropped 1.98% to close at R97.74. The Spar Group [JSE:SPP] declined 3.77% to close at R186.50 despite releasing a modest trading statement, while Pick n Pay [JSE:PIK] also slipped 1.72% to close at R64.00 despite the firmer rand.

The JSE All-Share index eventually closed 0.23% firmer while the blue-chip JSE Top-40 index rose 0.38%. The Financials index managed to eke out gains of 0.14%, while the Industrials and Resources indices rose 0.27% and 0.51% respectively.

Brent crude rebounded along with global stocks as it was recorded 1.99% firmer at $54.33/barrel just after the JSE close.

At 17.00 CAT, Gold was down 0.05% at $1571.19/Oz, Palladium was 0.51% weaker at $2341.07/Oz, and Gold was up 0.88% at $968.82/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.