Local markets traded lower amidst thin trade on Tuesday, easing off the recent rally on the JSE. All the major indices closed in the red, coinciding with the surprise cabinet reshuffle by President Jacob Zuma.

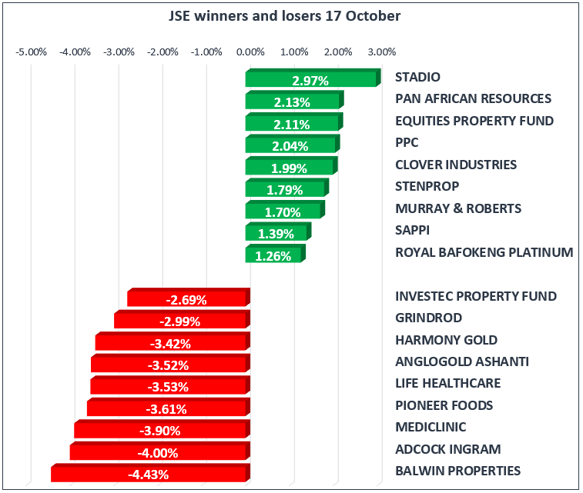

The All Share index fell 0.48% while the blue-chip Top 40 slipped 0.39%. The markets were dragged lower by the gold index, which fell 1.78% on the back of lower gold prices. The markets also took a knock from financials falling 0.74%, Resources 0.48% and Industrials 0.38%.

Locally, the market response has been marginal relative to previous cabinet reshuffles involving former finance minister Pravin Gordhan. The changes to cabinet, the second time in 2017, represent heightened political concern with the rand weakening to R13.41 to the greenback. The dollar has also been supported by a rise in US treasury yields, as the market anticipates higher interest rates going forward.

Discovery [JSE:DSY] climbed 0.28% to R143.80, following the announcement that the company had been granted a banking license. Discovery already have a large subscriber base for their branded credit card.

Naspers [JSE:NPN] gained 0.42% to R3252.51 despite its large Chinese investment, Tencent, falling 0.22% in Hong Kong.

Global equity markets were largely negative, with European markets closing in the red, and US markets trading lower at the close of the JSE; with the UK FTSE down 0.14%, Germany’s DAX 0.07%, and the French CAC edging 0.03% lower.

South African supermarket operator Pick n Pay [JSE:PIK] reported a drop in half-year earnings after cutting jobs as part of an intensifying price battle with rivals in a stalling economy. On the JSE, shares in the company gained 0.40% and closed at R60.10 following the release of results which saw HEPS fall to 61.88 cents for the six months to end-August from 82.43 cents a year earlier.

Excluding severance costs, earnings rose by around 13%, marking a ninth consecutive period of profit and sales growth, the company said in a statement. Pick n Pay has changed its sales model to focus on pushing ‘in-house’ private label products, increasing the share of the “no-name” higher-margin products to 19 % of sales, from 5%

In the US, Netflix [NASDAQ:NFLX] jumped to a new all-time high in AH trading, climbing 2.2% to $207.21 per share, after posting Q3 results. The video streaming service added 5.3M net subscribers this past quarter and outlined a new content budget of between $7B-$8B for next year.

Gold prices slipped 0.73% to $1284/Oz marking a poor start to the week as global risk appetite is positive despite heightened geopolitical tensions in Iraq.