The JSE gave up earlier gains to close softer on Thursday as local sentiment remained largely bearish given weaker local and global economic fundamentals.

With the thought of a recession on every investor’s radar, the pursuit of safe-haven assets remains the order of the day as investors search desperately for a safety net. Treasury bond yields for developed markets have continued to decline with investors even seeking negative yielding Treasury bonds from some European countries.

In Asia stocks traded mixed as the Hang Seng had some relief as it gained 0.76% while in China the Shanghai Composite Index added 0.31%. In Japan the Nikkei came under significant pressure to end the day 1.21% lower. All the major indices in Europe tracked lower on the day, while in the USA stocks off shelved the trade war concerns as they opened firmer.

The rand traded mostly firmer on the day as it advanced to peak at a session high of R15.20/$. At 17.00 CAT, it was recorded trading 0.9% firmer at R15.26/$.

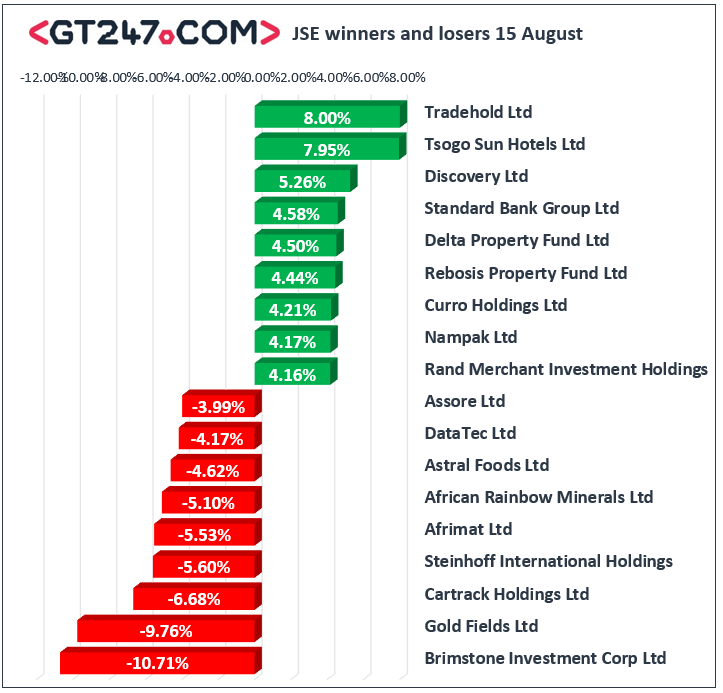

On the JSE, Gold Fields [JSE:GFI] came under significant pressure despite reporting a return to profitability in its half-year results released on Thursday morning. The miner tumbled 9.76% to close at R80.93. Commodity trading giant Glencore [JSE:GLN] fell 3.63% as it closed at R41.16, while mining giant Anglo American PLC [JSE:AGL] lost 3.49% to close at R313.18. Other significant losses on the day were recorded for Steinhoff International [JSE:SNH] which lost 5.6% to close at R1.18, African Rainbow Minerals [JSE:ARI] which dropped 5.1% to close at R152.23, and Richemont [JSE:CFR] which fell to R115.00 after losing 2.46%.

Rand sensitives led gains on the day primarily due to the firmer rand. Standard Bank [JSE:SBK] rose 4.58% to close at R173.50, Nedbank [JSE:NED] added 3.66% to close at R223.53, and FirstRand [JSE:FSR] closed at R56.61 after gaining 2.85%. Discovery Ltd [JSE:DSY] rebounded to end the day 5.26% higher at R105.99, while Imperial Holdings [JSE:IPL] gained 2.52% to close at R47.23 despite releasing a weaker trading update for its full financial year. Retailers also advanced on the day which saw Massmart [JSE:MSM] climb 1.79% to close at R45.02, while The Foschini Group [JSE:TFG] gained 1.87% to close at R149.88.

The JSE All-Share index eventually closed 0.49% lower while the JSE Top-40 index shed 0.33%. The Financials index was buoyed by the firmer rand which saw the index climb 2.35%. The Resources and Industrials indices fell 2.15% and 0.64% respectively.

At 17.00 CAT, Gold was up 0.15% to trade at $1518.85/oz, Platinum had shed 0.53% to trade at $840.75/Oz, and Palladium had gained 1.48% to trade at $1450.30/Oz.

Brent crude slipped further in today’s session and it was recorded trading 2.61% weaker at $57.95/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.