The JSE closed mildly firmer on Thursday as markets remained buoyant following significant gains over the past two sessions.

In today’s session the rally was spurred by news that China plans to cut tariffs on $US75 billion worth of American imports which gave further impetus for investors to seek riskier assets. China also recently announced a cut in the reserve requirement for Chinese banks in a move aimed at improving liquidity in the markets. These active steps to promote growth are giving investors confidence that the impacts of coronavirus will not have a major impact on the global economy.

There was some disappointment locally as the SACCI Business Confidence index for January fell to 92.2 from a prior recording of 93.1. The rand weakened significantly prior to the release of this data as it reached a session low of R14.88/$. The rand was trading 0.59% weaker at R14.85/$ at 17.00 CAT.

Don't miss this valuable research note ahead of the Non-Farm Payrolls announcement tomorrow at 3.30pm, 7th February 2020:

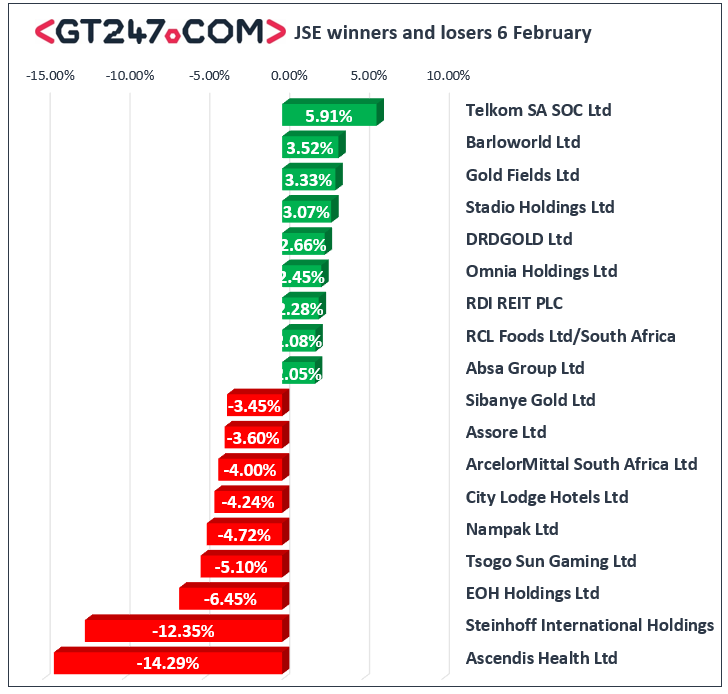

On the local bourse, Telkom [JSE:TKG] recorded stronger gains in today’s session as it surged 5.91% to close at R34.95, while Barloworld [JSE:BAW] finished amongst the day’s biggest gainers after it advanced 3.52% to close at R99.36. Gold Fields [JSE:GFI] was lifted by the release of a positive trading update which saw the stock gain 3.33% to close at R94.86, while DRD Gold [JSE:DRD] added 2.66% to close at R8.89. Financials advanced despite the weaker rand as gains were recorded for Standard Bank [JSE:SBK] which advanced 1.67% to close at R167.76, as well FirstRand [JSE:FSR] which climbed 1.62% to close at R60.75. Significant gains were also recorded for British American Tobacco [JSE:BTI] added 1.95% to close at R667.00, and Multichoice Group [JSE:MCG] which closed at R106.13 after gaining 1.52%.

The volatile trading on Steinhoff International [JSE:SNH] continued as the stock peaked at a session high of R1.65 before it slipped to a session low of R1.33. Eventually the share closed 12.35% lower at R1.42. Tsogo Sun Gaming [JSE:TSG] also came under significant pressure as it fell 5.1% to close at R10.05. while Sibanye Gold [JSE:SGL] slipped 3.45% to close at R37.25. Assore [JSE:ASR] traded softer on the back of the release of a weaker trading statement in which the miner highlighted tough trading conditions. The stock closed 3.6% weaker at R232.02. Impala Platinum [JSE:IMP] traded weaker despite reporting a significant increase in earnings in its trading statement. The stock closed 3.42% lower at R145.11. Harmony Gold [JSE:HAR] also struggled despite releasing a positive trading statement as it lost 2.93% to close at R45.70.

The JSE Top-40 index closed 0.25% firmer while the broader JSE All-Share index gained 0.18%. The Resources index came under mild pressure as it lost 0.43%. The Industrials and Financials indices gained 0.34% and 0.91% respectively.

Brent crude was trading 0.92% weaker at $54.74/barrel just after the JSE close.

At 17.00 CAT, Gold was up 0.43% at $1563.03/Oz, Palladium had lost 1.58% to trade at $2393.49/Oz, and Platinum was 1.11% weaker at $971.00/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.