The JSE closed firmer on Wednesday after a relatively flat trading session.

Global markets were tentative on Tuesday as the UK parliament was scheduled to vote on Prime Minister Theresa May’s Brexit deal. The vote was a resounding no, however US equity markets were unperturbed as they closed firmer on Tuesday, and even extended gains in today’s trading session. In Asia, weakness was recorded on the Japanese Nikkei which shed 0.55%. In mainland China, the Shanghai Composite Index closed flat while the Hang Seng inched up 0.27%.

US equity futures were buoyant on the back of good earnings releases from some of the USA’s biggest banks namely Goldman Sachs and Bank of America, which saw the cash market open firmer. This positive sentiment was evident on the major equity bourses in Europe and on the JSE.

On the local front, there was disappointment as mining production data for November reflected a significant contraction. MoM Mining Production contracted by 5.8% which missed the forecasted expansion of 2.5%, while YoY it decreased by 5.6% missing an estimated growth of 1%. As a result, the resources index on the JSE traded under significant pressure.

Gains were fairly modest amongst the local bourse’s blue chip stocks as Vodacom [JSE:VOD] led that counters’ gains after rising 3.55% to close at R136.39. The firmer rand resulted in rand sensitives such as ABSA Group [JSE:ABG] gaining 2.75% to R175.70, Spar Group [JSE:SPP] rose 1.91% to R210.72, while Pick n Pay [JSE:PIK] firmed to R75.59 after adding 1.87%.

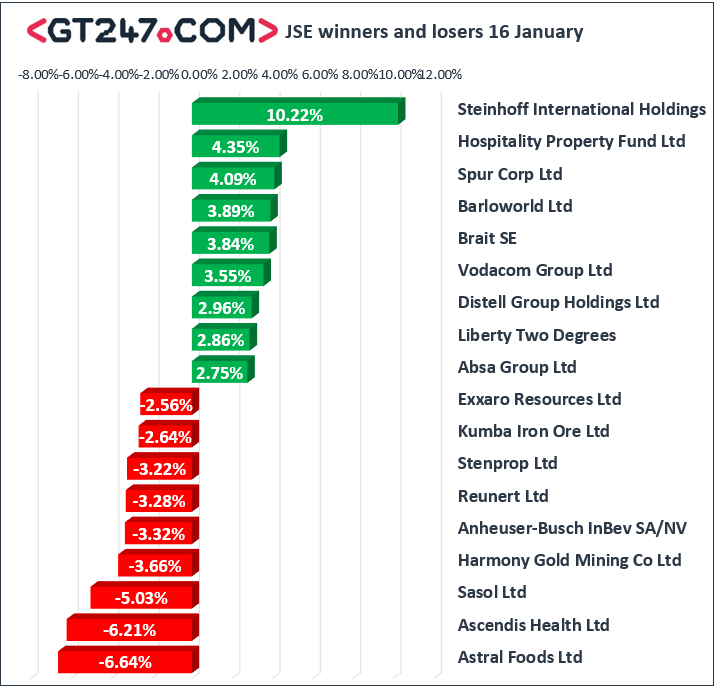

Steinhoff International [JSE:SNH] was the day’s biggest gainer after it climbed 10.22% to close at R2.05. Barloworld [JSE:BAW] managed to post gains of 3.89% to close at R123.24, while Brait [JSE:BAT] staged a minor recovery following its recent slump as it gained 3.84% to end the day at R27.28. Liberty Holdings [JSE:LBH] rose to R110.19 after gaining 2.02% while Growthpoint Properties [JSE:GRT] closed 1.99% firmer at R24.64.

Astral Foods [JSE:ARL] came under significant pressure as it lost 6.64% to end the day at R154.00, while Ascendis Health [JSE:ASC] fell 6.21% to R5.59. Oil and gas producer, Sasol [JSE:SOL] also struggled as it dropped 5.03% to close at R417.48. Miners were dragged by the release of weaker mining production data. Harmony Gold [JSE:HAR] lost 3.66% to close at R24.71, Kumba Iron Ore [JSE:KIO] shed 2.64% to R279.65, Exxaro Resources [JSE:EXX] closed at R145.82 after dropping 2.56%, and Sibanye Stillwater [JSE:SGL] lost 2.42% to close at R9.66.

The JSE All-Share index eventually closed 0.47% firmer, while the JSE Top-40 index inched up 0.6%. The Resources index fell 1.26%, however decent gains were recorded for the Financials and Industrials indices which gained 1.11% and 1.09% respectively.

The rand was trading firmer against the US dollar on the day, and at 17.00 CAT it was recorded at R13.70/$.

Brent crude was trading flat at $60.69/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.24% firmer at $1292.60/Oz, Platinum was up 0.61% at $804.48/Oz, and Palladium had shot up 2.73% to trade at $1358.84/Oz.