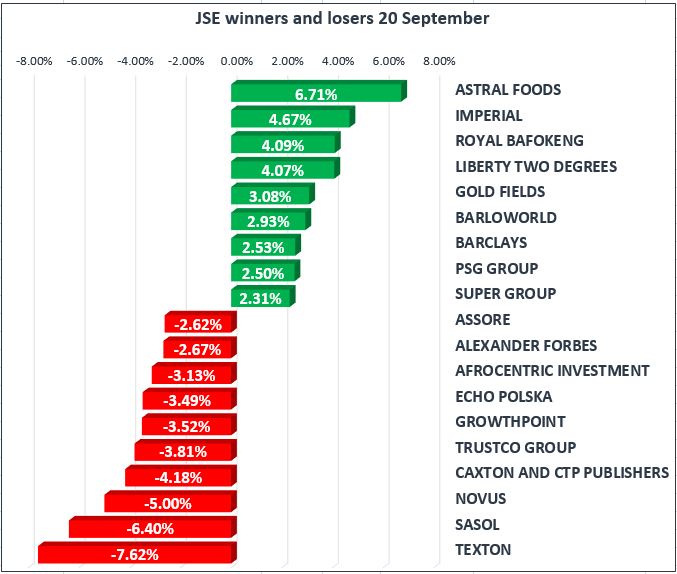

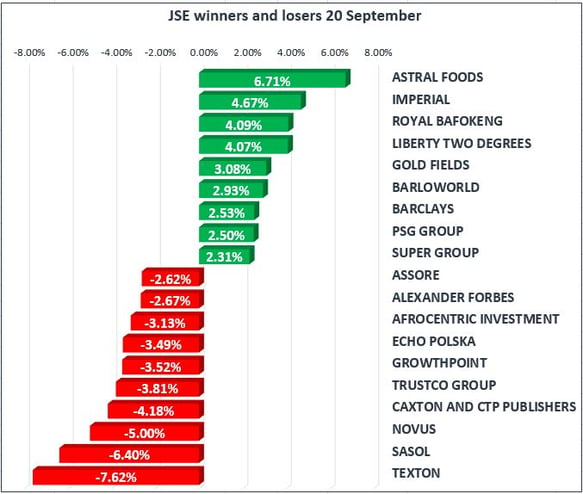

Cape Town – the JSE closed lower on Wednesday, dragged down by a collapse in the price of Sasol following news that the business would write off more than R10bn from a 2008 BEE empowerment deal.The All-Share index traded 0.26% lower, while the blue-chip Top 40 lost 0.35%.

The rand firmed slightly to R13.26 against the greenback, due to general dollar weakness ahead of this evenings US federal policy meeting. The Federal Reserve is widely expected to announce that it will start unwinding its $4.5 trillion balance sheet and that rates will remain unchanged.

Sasol [JSE:SOL] announced that it would buy back the outstanding R12bn of shares from Sasol Inzalo investors and replace them with a new broad-based black economic empowerment deal,dubbed Khanyisa, valued at R21bn. The news dropped the share price by 6.4% to R373.00, wiping almost R17 billion rand from its market value. According to Analyst Mark Ingham, while the new deal is quite complicated – the knee jerk sell off by the market has been an over-reaction.

Newly listed Steinhoff Africa Retail [JSE:SRR] closed the session at R21.52, after initially listing at R20.58 per share, with over 67 million shares traded.

US markets traded marginally lower as investor await the Federal Reserve’s latest decision on when it will begin reducing its extensive balance sheet. At the close of local markets, the S&P 500 was down 0.02%, with information technology and consumer staples contributing the most to the losses.

The highly-anticipated move signals the central bank's effort to reverse the asset purchases it made as part of the extraordinary quantitative easing program it created to save the economy during and after the financial crisis.

Brent crude prices moved higher to $56.15/bbl on the hopes that Opec and its partners would extend their production cuts designed to deal with a global supply glut. Crude is on track for its biggest third quarter gain in 13 years.

Gold prices remained stable at $1311/Oz as market participants’ expectations regarding the future trajectory of Federal Reserve policy kept traders at bay. Interest rates and the US dollar are two of the most crucial elements that influence the price of gold.