Cape Town – the JSE struggled to get ahead on Thursday following a delayed start to the trading day due to technical issues at the exchange.

The repo rate was left unchanged at 6.75% with Reserve Bank governor, Lesetja Kganyago, citing political risks, the prospect of further sovereign credit-ratings downgrades, and electricity tariff hikes as reasons to keep the rate unchanged.

The rand firmed on the back of the decision, gaining 0.34% to R13.28 against the dollar. A higher interest rate attracts investors to fixed income instruments in South Africa, increasing demand for the rand.

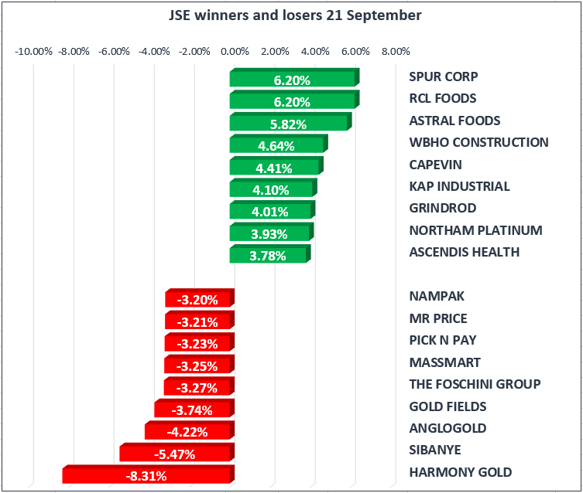

The All Share index gained 0.13%, while the blue-chip Top 40 moved 0.11% higher. Markets were supported by Industrials which gained 0.26% and Resources which climbed 0.26. Gold miners came under severe pressure after the price of gold softened below $1300/Oz, which saw the overall index fall by 4.89%

Harmony Gold [JSE:HAR] fell by 8.31% to R23.84 a share, while the Sibanye [JSE:SGL] dropped 5.47% to R15.22, Anglogold [JSE:ANG] moved 5.33% lower to R121.38 and Goldfields [JSE:GFI] closed 3.7% lower at R57.35.

Sasol [JSE:SOL] regained some of yesterday’s losses and edged 1.34% to R374.32. The company announced that it would introduce a new broad based black economic transaction that would add 20% direct ownership in Sasol South Africa. The deal is set to replace the previous ‘Inzalo’ scheme which was implemented in 2008 and matures in June 2018.

The ‘Inzalo’ deal was dependent of the share price of Sasol, and if the current price range prevails, there will be no transfer of ownership and a cash deficit. At the end of June 2017, Sasol had R12 billion in debt arising from preference shares issued by Inzalo BEE entities. The Sasol shares held as security for this debt had a spot value of around R9,5 billion. Sasol consolidates the debt on its balance sheet and the deficit is R4 per Sasol share

To introduce the new deal, dubbed ‘Khanyisa’, Sasol must issue approximately 34 million shares to raise cash to repurchase Inzalo entity shares and fund the deficit in Inzalo. This will only happen after shareholder’s vote on the new transaction in November. The new issue is 5% of the current shares in current issue.

In the United States, the FOMC held the Federal Funds rate steady but still expects to hike one more time between now and year-end. The central bank will also begin to trim back its balance sheet next month with a $10B reduction.

The price of gold retreated by 0.70% to $1292/Oz on Thursday, following a decline in the previous two sessions. The timing of the Federal Reserve decision to unwind an inflated balance sheet has led to a dollar rally which has subsequently curbed appetite for the precious metal.

Brent Crude prices held steady at $56.28/bbl as traders await American oil rig data, to determine the level of supply available. Oil stockpiles in the US have come under pressure as the recent spate of hurricanes has knocked out a large amount of the US refining capacity, pressuring supply levels of petrol.