Retailers and Financials firmer, as the rand gains on political decision to allow a secret ballot for the vote of no confidence against President Zuma

The JSE closed firmer on Monday with the market gapping higher at the open. The JSE Top40 is closing in on a record 50,000 level, following US markets closing firmer on Friday.

National Assembly speaker Baleka Mbete’s decided on Monday afternoon that the vote on the motion of no confidence in President Jacob Zuma will be conducted via secret ballot. The announcement resulted in an immediate strengthening of the rand, with the local currency rallying to under R13.20.

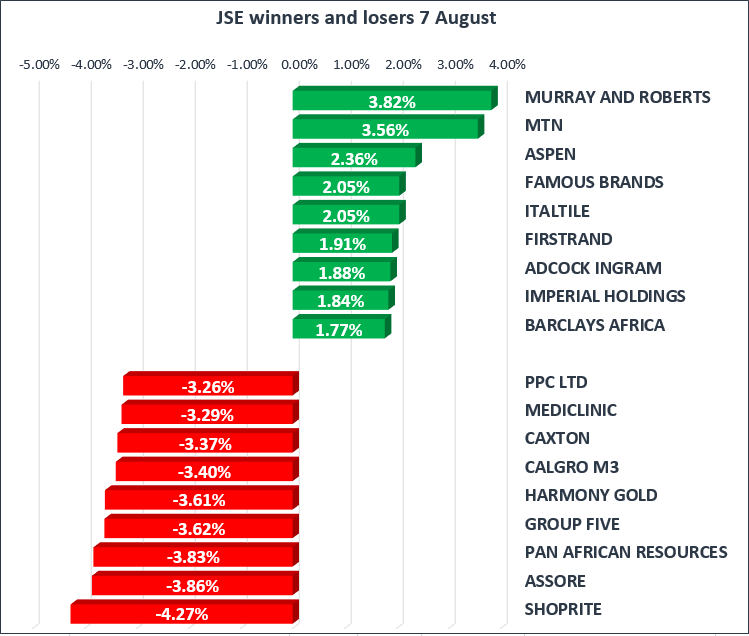

The firmer rand resulted in a late rally in financial stocks and retailers, with Firstrand [JSE:FSR] gaining 1.91% to R53.59, Barclays-Africa [JSE:BGA] 1.82% to R147.65, Nedbank [JSE:NED] 1.69% to R226.15 while Standard Bank [JSE:SBK] closed flat at R166.00.

The JSE All share index rose 0.39%, while the blue-chip Top40 gained 0.52%. The market was generally firmer, led by Industrials gaining 0.54%, Financials 0.35% and Resources 0.18%.

Steinhoff gained 1.77% and closed at R70.35 per share. Just before the close on Friday Steinhoff released SENS announcements, detailing updates on the separate listing of their African assets under a new entity called STAR (Steinhoff Africa Retail). STAR will include familiar retail brands such as Pep, Ackermans, Shoe City, JD Group, Timbercity, and Tekkie Town.

STAR is targeting the acquisition of a controlling stake in Shoprite through a call option structure between themselves, Dr Christo Wiese and the PIC. Shoprite closed the trading session down 4.27% to R200.73 per share.

Last week, the US Department of Labour released data indicating that non-farm jobs increased by 209 000 in July, following a 231 000 increase in June and above market expectations of 183 000. The unemployment rate decreased to 4,3% in July from 4,4% in June and the labour participation rate was up to 62,9% from 62,8% in June.

Brent Crude Oil decreased by 1.03% to $51.88/bbl. Last week, oil prices settled higher, aided by signs of a possible slowdown in U.S. shale production. However renewed concerns over OPEC's compliance with the deal to curb production has reversed gains.

Representatives from OPEC and non-member nations are gathering in Abu Dhabi today. The conference has been called to discuss the poor conformity levels on their output cut agreement. According to Bloomberg data, compliance fell to 86% in July, the lowest level since January.

-1.png?width=583&height=495&name=7%20August%20(002)-1.png)