The JSE closed lower today as it took a leaf from the current downtrend in global markets.

Locally we woke up to news of North Korea firing a missile over Japan which increased global security concerns. This immediately led to a spike in Gold as the precious metal bounced on safe haven buying. As a result Asian markets tracked lower in today’s session and our local bourse followed suit.

Bidvest was on the losers list once again as it lost 1.58% to close at R172.00 per share. Sappi and Intu Properties were also trading under pressure as they shed 2.58% and 1.22% respectively. Most of the retailers and financials stocks continued to trade under pressure despite a relatively firmer Rand. In today’s session the Rand managed to yet again break below R13/$ to reach an intra-day high of R12.95 against the greenback.

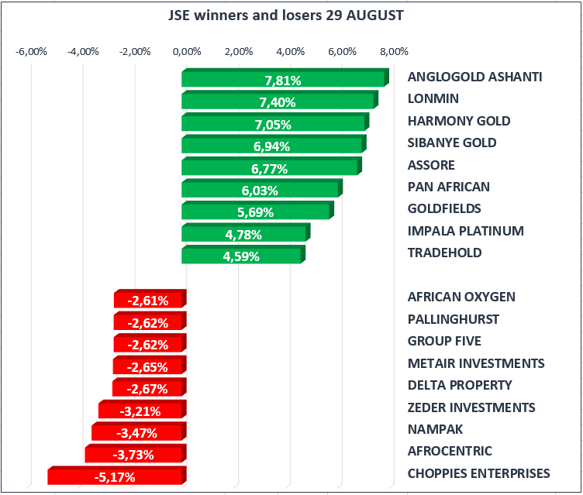

In terms of earnings releases, Sibanye Gold released a trading statement which indicated that they are expecting a loss of 324 cents per share and a headline loss of 147 cents per share for the 6 months ended 30 June. This amounts to a decrease of 1450% in earnings per share and 286% in headline earnings per share. This trading statement is no surprise given the acquisition of Stillwater Mining in the US, and investors should expect decreased earnings in the medium-term until the new acquisition starts feeding into the stocks’ earnings. Sibanye Gold closed up 6.94% mainly on the back of the commodity rally that we are seeing.

The JSE All-Share Index closed 0.26% lower, whilst the Top-40 Index was down by 0.35%. The Resources Index was the only major index to close in the green as it gained 0.37%. The Industrials Index shed 0.53% whilst the Financials Index lost 0.30%.

The US Dollar Index remained under pressure as it broke down 92 index points to reach an intra-day low of 91.621 index points. As a result, most US Dollar cross currency pairs did strengthen against the greenback, with the EUR/USD in particular breaking out above 1.20 Euros to the US Dollar.

Gold benefitted from the slump in the US Dollar as it continued to track higher in today’s session. It peaked to an intra-day high of $1326.08 per ounce before retracing slightly to trade at $1319.30 per ounce just after the JSE closed. As a result, JSE listed Gold miners Gold Fields and Harmony Gold closed up 5.69% and 7.05%.

The current commodity bull market saw Platinum and Palladium having yet another positive session. Palladium peaked to an intra-day high of $949.44 per ounce and just after the JSE closed it was trading at $948.35 per ounce. Platinum managed to jump above $1000 per ounce to reach an intra-day high of $1006.00 per ounce. Platinum was trading at $1001.88 per ounce just after the JSE closed.

Surprisingly Brent Crude remained subdued despite fears of low USA supplies due to Hurricane Harvey. After opening at $52.04 per barrel the commodity was trading below that $52 per barrel for the greater part of today, and was recorded at $51.33 per barrel just after the JSE closed.