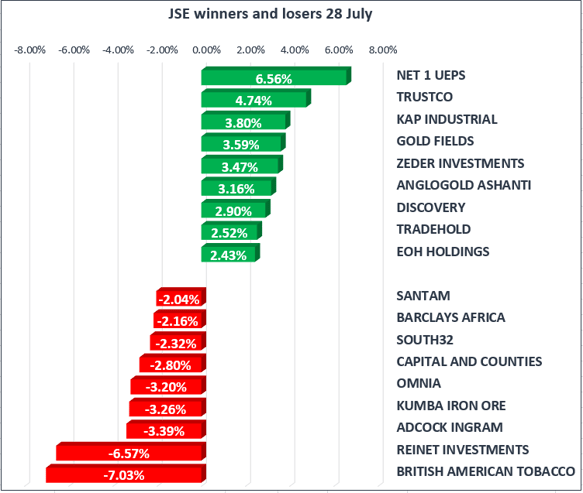

JSE edges lower as U.S. FDA threatens tobacco producers.

The JSE was dragged into the red by British American Tobacco [JSE:BTI] and Reinet [JSE:REI] which holds a large investment in BATS. The move occurred late in the local session after the US Food and Drug Administration announced that it will work to cut the amount of nicotine in cigarettes to nonaddictive levels.

The move threatens to deal a blow to tobacco companies, which are already dealing with lessening cigarette volumes in the US. The FDA’s efforts are likely to be opposed, as cigarette makers lobby to ensure that they fend of heightened regulations.

BATS fell 7.03% to R844.47 while Reinet fell 6.5% to R28.30. The rand closed the session at R13.01 against the dollar, failing to make any meaningful or sustained gains as the dollar index weakened.

The JSE all share index edged lower to 0.01% while the blue-chip Top40, which holds a heavier weighting of BATS and Reinet, fell 0.04%. Gold miners gained 2.74%, resources gained 0.71% and financials sneaked 0.03% up.

Crude Oil climbed 0.90% to $51.43/bbl as investor expectations grew that U.S. crude supplies would continue to drop during the second half of the year, easing the global glut in supply. Greater consumption of oil in the US has resulted in the seasonal drawdown of stockpiles, which may be reversed after September. Nonetheless, the oil market tends to overreact to near term developments.

Kuwait's state run oil company has pledged to cut sales volumes of oil for 2017, one day after the UAE promised to cut its own crude exports by 10% starting in February, and just two days after Saudi Arabia promised to curb oil exports starting in August.

Gold prices firmed on Friday by 0.82% to $1268/Oz as investors bought into the precious metal on the back of a sharply weaker dollar due to mild U.S. second-quarter growth data. The market was expecting growth of 2.7% but the actual figure reported came in at 2.6%.

The positive number does indicate that the US economy has expanded for eight years, energised by monetary stimulus. he U.S. has added 16.6 million new jobs since 2010 to drive the unemployment rate down to a nearly 16-year low of 4.4%