The JSE struggled to gain any momentum from the open as it traded under pressure for the greater part of today’s session.

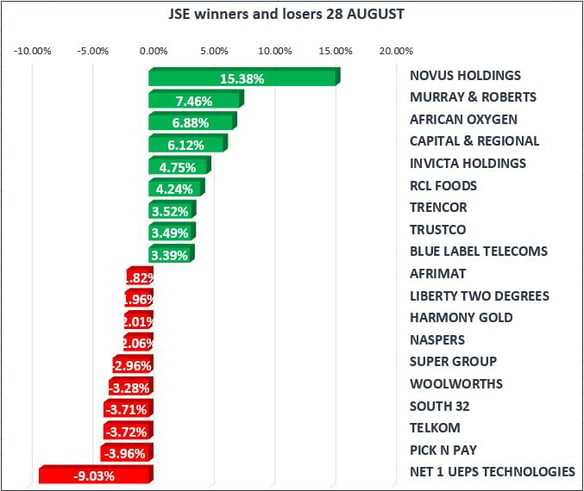

The local bourse failed to gain any traction as index heavyweight, Naspers, dragged it lower. Banking stocks which are starting to show signs of being overbought failed to gain any upside despite a relatively firmer Rand. The Rand managed to briefly break below R13 to the US Dollar, but it eventually weakened slightly to trade at R13.04/$ just after the JSE closed. First Rand, Standard Bank and Barclays Africa all traded under pressure eventually closing the day down 0.54%, 0.54% and 0.01% respectively. Retailers Mr Price and Woolworths were also trading under pressure as they shed 0.80% and 3.28% respectively.

On the gainers, AngloGold Ashanti had a change of fortunes as it inched up 2.54% whilst its Top-40 Index peer, Gold Fields managed to gain 1.75%. Murray and Roberts jumped 7.46%, whilst Rand hedge stocks Richemont and Mondi Ltd managed to close the day 0.64% and 0.14% firmer.

Bidvest and Adapt IT released their full year results today and subsequently they traded under pressure for the rest of the day. Bidvest recorded a 5% rise in headline earnings per share to 1108 cents for the year ended June 2017, with earnings increasing by 6% to R3.7 billion. It is important to note that Bidvest derives all of its revenue from South Africa and given the current economic climate their results are very respectable. They are looking to grow abroad through acquisitions as evidenced by the recent acquisition of Noonan in Ireland. Bidvest closed the day down 0.48% at R174.76 per share.

Adapt IT increased its EBITDA by 18% to R194 million whilst normalised earnings per share increased by 10% to 79 cents for the year ended June 2017. The business recorded 25% growth in turnover of which 19% was from acquisitions. The number of shares has increased by over 40% since 2013, and the share has been under pressure since December 2016. Adapt IT closed the day down 0.56% at R8.90 per share.

The JSE All-Share Index never recovered and ended up closing 0.18% lower, whilst the blue chip Top-40 Index shed 0.23%. The Financials Index closed down 0.08% whilst the Industrials Index lost 0.42%. The Resources Index managed to bounce on the back of firmer commodity prices to close the day up 0.21%.

Gold managed to spike up above $1300 per ounce right before the JSE closed, which was anticipated given the current weakness in the US Dollar. The precious metal was trading $1306.87 per ounce just after the JSE closed as it continued to show signs of being bullish. The US Dollar Index continued on its downward trend as it reached an intra-day low of 92.316 index points, this is after it closed at 92.740 points on Friday.

Platinum and Palladium continued on their upward trajectory following the current bull trend in metal commodities. Platinum managed to reach an intra-day high of $987.19 per ounce, whilst Palladium peaked at $938.40 per ounce.

Brent Crude opened the day firmer on the back of Hurricane Harvey fears in the USA. The commodity peaked to an intra-day high of $52.84 per barrel but it subsequently fell below $52 per barrel, and when the JSE closed it was trading at $51.80 per barrel.