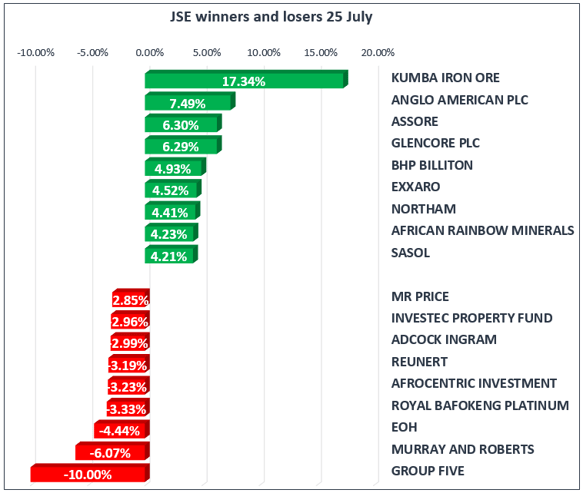

Resources rally pulls JSE higher

Resources emerged as the shining light on the JSE on Tuesday, keeping the overall index in the green. Commodity prices were broadly higher, combined with the weaker rand, which slipped 0.68% to R13.03 at the close of the market.

The broader All Share index gained 0.24%, whilst the blue-chip Top40 gained 0.34%. Markets were let down by Financials falling 0.64%, Industrials 0.59% and Gold miners 0.29%. The gain in resources skewed the market into positive territory, with the index climbing 3.69%.

Kumba Iron Ore [JSE:KIO] rallied 17.34% to R193.46 per share as the company announced that it will resume dividends for the first time in two years due to an increase in iron ore prices along with more efficient production methods which have helped boost first-half earnings by 53 percent to R4.6 billion.

Sasol [JSE:SOL] gained 4.21% to R387.50, despite news that headline earnings declined by between 11% and 21% during the 12 months to end-June due to the strong rand and weaker oil prices.

Shares in Long4Life [JSE:L4L] slid 22.31% after the company raised its bid for Holdsport [JSE:HSP], which owns Sportsmans Warehouse and Outdoor Warehouse. The offer is now 12.10 ordinary shares in Long4Life for every one Holdsport share. This means 494,3 million new L4L shares or R3 billion, which is more than 25% higher than previously.

The price of crude oil gained 2.70% to $49.91 as Saudi Arabia pledged deep crude export cuts next month and supplies in the US are seen declining.

The Trump administration is reported to be considering slapping sanctions on Venezuela that will include a ban on importing crude oil from the nation. The move is seen as benefiting Canadian and Alaskan oil producers. The U.S. imported 673K barrels of oil per day from Venezuela last month.

Traders are also factoring in indications from yesterday's OPEC meeting of oil production cuts from Saudi Arabia and Nigeria. Meanwhile, the OPEC cartel's blame for why prices have remained so low is shifting from U.S. shale production toward its own members, and whether they're holding the line on agreed-to production limits.

The Federal Reserve's Open Market Committee begins its two-day meeting on interest rate policy today, but unlike last time, expectations are that a new short-term rate hike isn't on the agenda. Instead investors are looking for language that could clue them into future increases, as well as any inkling to when the Fed will start paring its bond holdings. The dollar index, meanwhile, recovered from a near 13-month low on Tuesday.