The JSE continued to progress on Friday, helped by a recovery in the share price of Steinhoff, after the company refuted allegations of fraudulent activity.

The rand strengthened considerably, aiding financials and banks, and closed the session at R13.08 against the greenback, following general dollar weakness. The dollar weakened in choppy trade following Janet Yellen’s speech at the Jackson Hole symposium, with the Fed chair avoided speaking about the future of monetary policy in the states, offering no clues to investors.

Dollar weakness was aided by headline US durable goods orders data was slightly weaker than expected with a 6.8% decline for July.

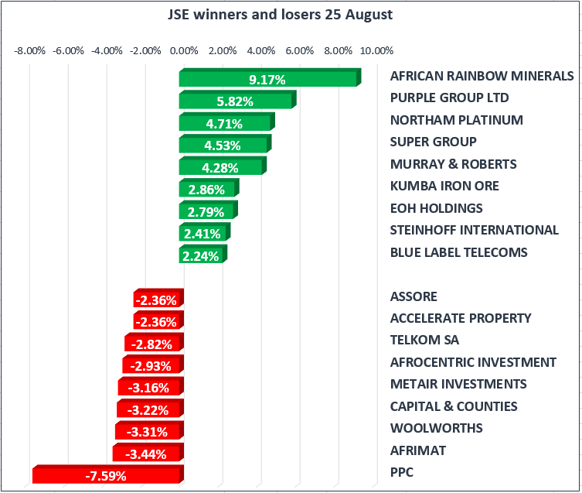

Steinhoff led the Top 40 and gained 2.87% on Friday, taking the stock up to R61.30, following the aggressive sell-off on Thursday.

The All-share index gained 0.12%, while the blue-chip Top 40 gained 0.15% on 50175.33 points. The major indices were mainly driven by resources and financial shares. The Resources index traded 0.63% higher, and the Financial index also traded at a new intraday 52-week high and closed marginally higher by 0.01% to 43 046 points.

Standard Bank [JSE:SBK] gained 1.88% to R168.65, Nedbank [JSE:NED] was 0.94% stronger at R221.00, Firstrand gained 0.44% to R57.26 and Barclays Africa edged 0.33% to R153.27

The Industrial index slipped 0.05% as Naspers [JSE:NPN] dropped 0.24% to R3010.00

Gold gained 0.42% to $1291/Oz, and is now up 12% year to date. The safe-haven asset has struggled this considering the tense geopolitical environment. Gold prices are usually characterised by rising inflation or volatility, this year has been notable for stagflation and record low volatility in the United States equity markets.

Crude oil gained 0.50% to $52.30/bbl as Texas braces for a massive hurricane swirling in the Gulf of Mexico to hit the coast, which is dotted with major refining operations. An estimated 870,000 barrels of capacity may be curbed as refiners eye the storm's track which is set to drive through ‘refinery alley’ near Houston, Texas.