JSE firmer as Naspers and Vodacom continue positive momentum

Industrial stocks combined with retailers to drive the JSE higher on Monday.

The rand traded at 12.95 against the dollar at the close of the JSE, slightly weaker than the 12.94 on Friday. In the capital market, since early last week bond yields have decreased in line with the stronger currency.

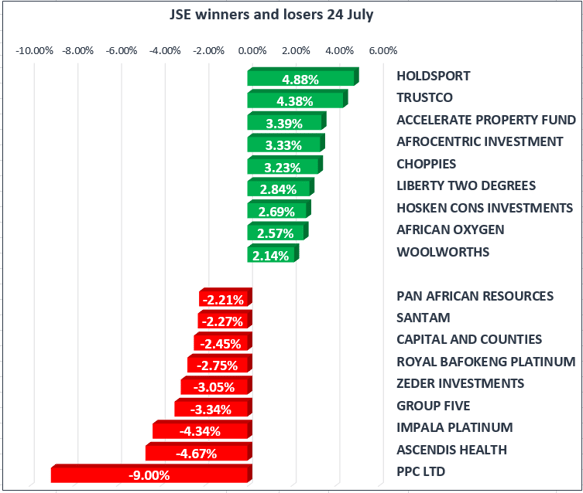

The All Share Index traded 0.38% higher, while the blue-chip Top40 gained 0.54%. The market was buoyed by industrials with Naspers [JSE:NPN] closing 1.92% higher at R2849.07, and Vodacom [JSE:VOD] gaining 1.44% closing at R183.10.

Anglo American Platinum [JSE:AMS] reported a 55% fall in profits for the first half of the financial year. The drop was blamed on lower commodity prices, a stronger rand and tax impairments. The company says that it is unlikely to pay a dividend this year, with the cumulation of bad news resulting in a 3% drop initially, before the share price recovered and closed 1.94% lower for the day at R305.47.

PPC slumped 9% to R4.45 at the close following the resignation of the CEO, Darryll Castle, after less than three years in the role. PPC and Afrisam are still in discussion regarding a possible merger.

Gold prices steadied 0.07% to $1255/Oz at the close of the JSE. The price of gold hit a one-month high as weaker dollar prices combined with political turmoil in the US boosted sentiment ahead of the FOMC meeting this week.

Brent crude price rose on Monday by 1.23% to $48.65/bbl after leading Opec producer, Saudi Arabia, pledged to cut its exports to help speed the rebalancing of global supply and demand. The Saudi minister of energy remarked that his country would limit crude oil exports at 6.6 million barrels per day.

European exchanges opened lower as the euro hit a 23-month high against the U.S. dollar, weighing on shares of European exporters. The U.S. Dollar Index dropped 1.4% last week and is down 1.7% this month after touching its lowest level in more than a year.

The European Central Bank left interest rates as well as its stimulus program unchanged last week. The ECB believes that while the current economic expansion has provided confidence that inflation will gradually increase, it is yet to translate to stronger inflation dynamics.

The IMF’s World Economic Outlook Update shows that global growth is expected to come in at 3,5% and 3,6% in 2017 and 2018 respectively, unchanged from earlier estimates. US growth forecasts have been lowered somewhat, while growth forecasts for the Euro Area, Japan and China have been raised. According to the IMF the risks around global growth are broadly balanced in the short-term, but are seen to be skewed to the downside over the medium term.