The JSE closed in the green as it was buoyed by retailers and financials which bounced on the back of the firmer Rand.

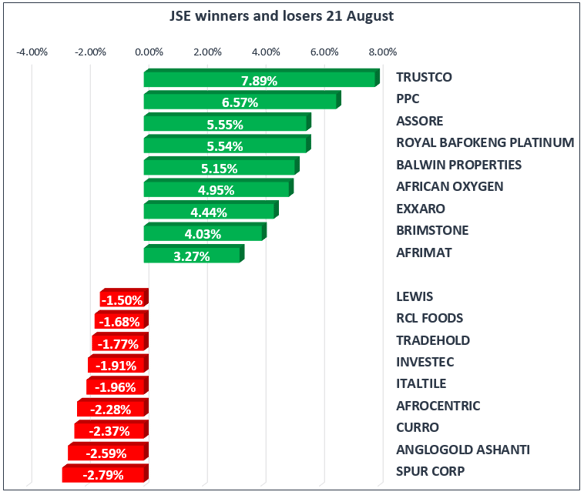

The Rand peaked to intra-day highs of R13.14 against the greenback which set the tone for Rand sensitive stocks. Truworths (JSE:TRU), Woolworths (JSE:WHL) and Mr Price (JSE:MRP) all bounced to close the day up 1.95%, 0.87% and 0.91% respectively. Gold Fields managed to close up 1.75% and it was one of the top movers in the JSE Top-40 Index, however AngloGold Ashanti (JSE:ANG) came under significant pressure after the release of their results earlier this morning. AngloGold Ashanti’s results indicated an adjusted headline loss of $93 million, as well as a free cash outflow of $161 million for the 6 months ended 30 June 2017. The share closed 2.59% lower at R131.18 per share.

BHP Billiton closed 1.08% firmer as it followed the trend in the primary Australian listing which closed up 1.22%. MTN retraced slightly today as it took a break from the upward trend that was recorded for the better part of last week. The stock closed down 0.87%, at R125.00 per share. Harmony Gold (JSE:HAR) also gave up some gains from last week as the stock ended the day down 0.68%.

Sasol released a relatively good set of results which indicated descent increases in sales volumes as well as a strong operational performance. Headline Earnings Per Share were down by 15%, however they recorded an increase in Earnings Per Share of 54%. Core Headline earnings were up by 6%. The stock price did bounce but it failed to break above R400 per share to eventually close at R392.80 per share, up 0.57% for the day. Notably, the Lake Charles project is 74% complete and the capital expenditure to date is $7.5 billion. Shareholders should expect lower profit margins in the medium term as costs are expected to increase.

The JSE Top-40 Index closed the day up 26%, whilst the JSE All-Share Index inched up 0.20%. The Industrial Index firmed by 0.11%, whilst the Financials Index was 0.13% firmer. The Resources Index jumped 0.76% as it was pushed higher by firmer commodity prices.

On the commodities front, metals continued on their bullish trend from last week. Gold tracked higher by more than $7 from its open but failed to gain enough momentum to test $1300 per ounce. The precious metal reached an intra-day high of $1293.85 per ounce, and just after the JSE closed it was recorded at $1292.44 per ounce.

Palladium continued to trade above $900 per ounce, reaching levels last recorded in 2001. The metal reached an intra-day high of $937.29 per ounce which aided Palladium miners Sibanye Gold (JSE:SGL) and Impala Platinum (JSE:IMP) as they closed up 0.36% and 1.03% respectively. Platinum followed a similar trend to reach an intra-day high of $986.45 per ounce. When the JSE closed it was trading at $983.85 per ounce.

Brent Crude opened significantly higher today compared to the close on Friday, as it opened at $53.00 per barrel. The commodity failed to maintain this momentum as it did not test that level again during the course of the day. The commodity was trading at $51.90 per barrel just after the JSE closed.