The JSE staged a late recovery to close marginally lower on Tuesday after a disappointing trading session.

The rand continued to slide and closed the session at R13.32 against the dollar.

At the close of the market, the All Share index had lost 0.07% while the blue-chip Top 40 gained 0.03% due to a heavier weighting of industrial shares which benefitted from the weaker rand. All major indices closed in the red, with gold miners down 0.32%, industrials lower by 0.08%, Resources and Financials matched at closing 0.03% weaker.

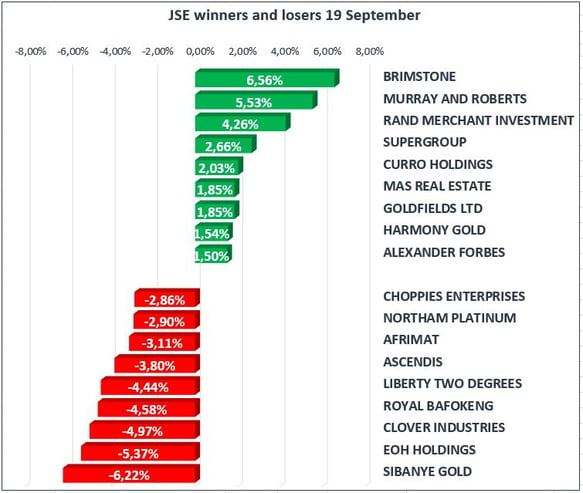

Sibanye Gold [JSE:SGL] made headlines as the share price fell 6.22% to R16.38 after announcing that it has launched an offering of US$450m unsecured bonds which will be converted into shares to refinance a loan used to purchase US platinum group metals producer, Stillwater. The conversion of debt to equity will further dilute the market value of the stock following the capital raise earlier this year.

Impala Platinum [JSE:IMP] recovered from its downward spiral and closed 0.06% higher to R33.22 after dropping reaching a low of R31.89. A softer rand combined with appreciation toward the businesses hardnosed approach to turn the company around managed to stop the price collapse. The management have indicated that they are set to cut at least 2500 jobs at its Rustenburg mining complex to stem losses and adjust to lower prices.

EOH [JSE:EOH] dropped 5.37% to R98.15 after first reaching a high of R109.04. Investors took profits off the table following the announcement of a 16% rise in profit for the year. According to the annual results for the year ended July 31, revenue grew by 21% to R15.490bn, while operating profit rose by 29% to R1.792bn. The share price of EOH has declined by more than 30% over the last few months due to allegations linking the firm to negative involvement with SASSA and other SOEs.

Crude oil prices eased 0.34% to $55.29/bbl after reaching fresh multi-month highs. Oil prices have remained supported by last week's bullish demand forecasts from OPEC and the International Energy Agency. Refineries along the Gulf coast of the US have started coming back online after being shut due to hurricanes Harvey and Irma and are set to increase supply available.

Gold Prices remained steady at $1308/Oz as fading tensions on the Korean Peninsula suppressed safe-haven demand. Investors will be eager to hear news from the Unite States Federal Reserve following their two-day meeting ending on Thursday.