Local equities take a hit as Rand strength drags down the JSE

The JSE traded weaker today as Rand hedge stocks were mostly under pressure due to the relatively firmer Rand.

The big factor in today’s trading was the continued weakness of the US Dollar which saw it reaching lows last recorded in September 2016. The US Dollar Index retreated to intra-day lows of $94.476 before recovering slightly to trade at $94.541 when the JSE closed. The Euro managed to reach highs last recorded in May last year, as the EUR/USD currency pair managed to reach highs of 1.157 against the greenback.

The Rand also strengthened against the US Dollar, following the trend in other major currency pairs. It managed to reach highs of R12.88 against the US Dollar, however it lost some of those gains and was trading at R12.93 when the JSE closed.

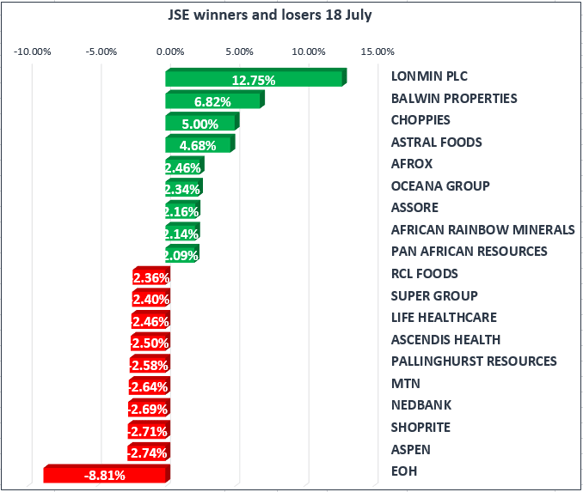

The JSE Top-40 Index shed 1.20%, whilst the JSE All-Share Index lost 1.05%. The trend was generally red for most of the major indices on the local exchange. The Financials Index closed down 1.12%, whilst the Resources Index shed 1.46%. The Industrials Index closed down 1.03%.

Anglo American Platinum (AMS) released an updated trading statement this morning for the 6 months ended 30 June 2017, which indicated that they are expecting Headline Earnings and Headlines Earnings Per Share (HEPS) to be down by between 67% & 47%. They are also expecting Basic Earnings and Earnings Per Share (EPS) to be down by between 169% & 188%. The stock traded under pressure for most of today’s session, reaching lows of R303.20 per share before having a minor recovery to close at R315.50 per share, down 0.80%.

Shoprite (SHP) released an operational update which was fairly positive. The update indicated an increase in group total turnover of 10.4% whilst like-for-like turnover growth increased by 5.8%. The non-South African supermarkets generated a higher sales growth compared to South African supermarkets, however this is mainly attributed to lower commodity prices and the devaluation of certain currencies. The impact of the drought in South Africa was not as severe, and it was also supported by a decrease in inflation. The stock closed down 2.71% for the day

Gold was positive on the day mainly due to the weakening of the US Dollar. The metal managed to reach intra-day highs of $1243.51 per ounce, and when the JSE closed it was recorded at $1241.74 per ounce. Despite firmer Gold prices, Gold miners on the JSE were mixed as they traded in-between both positive and negative territory. AngloGold Ashanti eventually closed down 0.43%, whilst Gold Fields ended the day 1.90% lower.

Platinum and Palladium traded mostly flat for the day as they traded in a relatively narrow range compared to the trend that is normally observed. The two metals were trading at $929.88 & $867.04 per ounce respectively when the JSE closed.

Brent Crude fell below $49 per barrel in today’s session managing to reach an intra-day low of $48.24 per barrel. This move saw Sasol dragged down which closed at R374.20 per share, down 1.50% for the day. Brent Crude was trading at $48.96 per barrel when the JSE closed.