WEAK DOLLAR NEUTRILISES THE JSE

The JSE All Share Index closed marginally lower, as gold miners lost their shine while the industrial index was pulled lower by a slip from Naspers.

The JSE ALL Share closed 0.05% lower followed by the blue-chip Top40 which ended the day 0.02% weaker. The rand managed to firm 0.51%, and traded at R13.11 to the greenback at the close of the session after weak housing data emerged from the United States.

Financials were boosted 0.37% by the stronger rand, with Banks increasing 0.80% while resources increased 0.24%. Industrials softened 0.34%, as Naspers [JSE:NPN] slipped 2.20% to R2670.00 per share.

Gold miners slipped 0.52% with the stronger rand offsetting firmer gold prices, as Harmony Gold dropped 0.66%, Anglo Gold 1.10%, Sibanye 1.27% while Gold Fields countered the trend and firmed 0.50%.

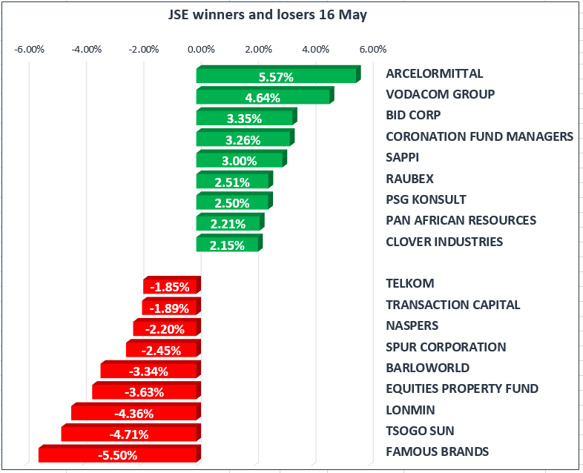

Vodacom [JSE:VOD] emerged as a big winner on the day, climbing to R159.95 per share as investors climbed into the stock on the back of strong results as well as the announcement of a 35% acquisition in Kenyan group, Safaricom via parent company Vodaphone.

Famous Brands [JSE:FBR] gained the title of the biggest loser as the share price dropped 5.50% to R136.85 per share after releasing a trading statement that reported a 15% - 25% decline in headline earnings per share.

U.S. government data released on Tuesday revealed unexpected declines in U.S. new-home construction and building permits in April indicate the market is off to a weak start this quarter. The dollar index is now flirting with its lowest levels since the election of President Trump, the downward momentum is supporting major currencies with the Euro, up 0.91% to $1.107, along with positive Eurozone GDP growth and German economic data.

Gold prices traded 0.59% higher at $1237.33 on Tuesday as weaker-than-expected U.S. manufacturing data weighed on the dollar, which underpinned an uptick in commodity prices, while geopolitical concerns over North Korea resurfaced. North Korea confirmed it had carried out a successful long range missile test on Sunday

Dollar-denominated assets such as gold are sensitive to moves in the dollar. A dip in the dollar makes gold cheaper for holders of foreign currency and thus increases demand.

Brent crude prices have ticked 0.08% higher to $51.85/bbl, due to a combination of dollar weakness and renewed confidence that Opec will extend production cuts until the end of the year.

Platinum gained $5.5 during the day, and was trading at $938.10 at the close of the JSE.