The JSE edged lower on Tuesday as commodity prices eased on the back of lower geopolitical stresses between North Korea and the United States.

The gold price was 0.73% lower to $1274/Oz after tensions eased between the United States and North Korea, following comments from U.S. officials downplaying the prospect of war on the Korean peninsula.

Losses in the precious metal, however, were limited as sentiment on tighter monetary policy remained subdued, following data on Friday showing the slowdown in US inflation continued in July. Gold is sensitive to moves in U.S. rates, which lift the opportunity cost of holding non-yielding assets such as bullion.

The rand firmed marginally to R13.29 at the close, with the JSE all share index dropping 0.87% and the blue-chip Top40 closing 0.92% lower.

All broad markets closed in the red, with gold miner and diversified resources dropping 2.87% and 2.24% respectively.

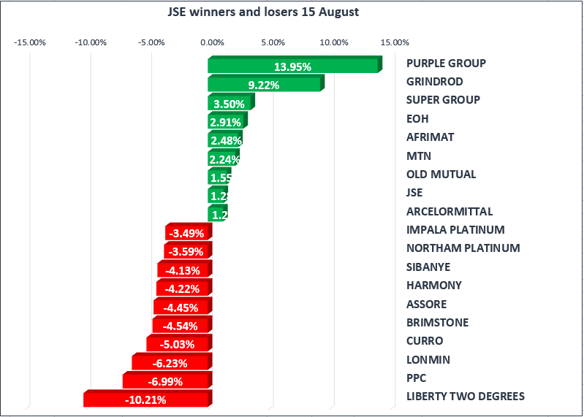

Purple Group [JSE:PPE] gained 13.95% on the news that Sanlam Investment Holdings will buy 30% of EasyEquities, an online stockbroking platform. Sanlam is paying R100m for the stake and will receive representation on the EasyEquties board.

Private education group Curro Holdings [JSE:COH] reported that revenue topped R1 billion for the six months ended June 2017, up 24% from R872 million before, and in line with growth in learner numbers and fee increases.

Crude oil prices moved lower to $50.51/bbl as data showed Chinese demand for oil eased in July while concerns over a rise in OPEC output continued to weigh on sentiment. Chinese refiners reached a 12-month low in production activity - highlighting concerns that a glut of refined fuel products could lessen demand for oil, reducing the prospect of oil inventories falling below the five-year average, adding further pressure on oil prices.