Resources and Industrials gain on back of weaker Rand

Local markets firmed on Tuesday on the back of a weaker rand, favouring resources and rand hedge stocks.

The rand weakened significantly and retreated to R13.54 at the close of the JSE. The US dollar index, which tracks the dollar against a basket of major currencies, firmed 0.11% - indicated general dollar strength.

In the capital market, South African bond prices weakened as bond yields increased in line with the weaker currency. The yields of the benchmark R186 2025 rose marginally to 8.892%. Higher bond yields put pressure on banking stocks as seen by the decrease in Firstrand [JSE:FSR] -1.27%, Barclays [JSE:BGA] -1.32% , Standard Bank [JSE:SBK] -1.32% and Nedbank [JSE:NED] -1.09%

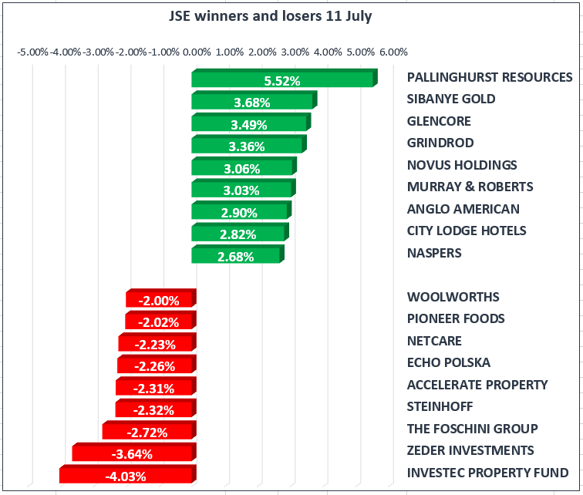

The banking stocks capped gains on the market, with the JSE all share index gained 0.36%, while the blue-chip Top 40 gained 0.47%. The Gold Index climbed 2.09%, followed by Resources 1.45% and Industrials 0.52%.

The rand was not supported by weaker South African manufacturing numbers for May. Manufacturing production declined by 0,8% y-o-y in May, from a 4,2% decrease in April. This was better than the consensus forecast of a 4,5% contraction. The annual decline was mainly driven by the ‘petroleum, chemical products, rubber and plastic products’ division which shaved off 2,1%.

On a seasonally adjusted basis, monthly manufacturing production contracted by 0,3% however it was up 0,4% for the quarter.

Statistics out so far in the second quarter suggest that economic activity remained relatively weak. Given the weak economy, decelerating food inflation and subdued global oil prices, the rand remains the key risk to the inflation outlook.

Naspers announced that it was selling its stake in a Turkish online retailer, Markafoni.com. The media giant rose 2.68% contributing much of the 0.52% move on the Top 40.

Crude Oil continued to rebound, gaining 0.75% and trading at $47.23/bbl at the close of the JSE. The possibility of production curbs in Libya and Nigeria and a shrinking of U.S. stockpiles lifting markets. Energy services company Baker Hughes announced on Friday that US drillers are now operating 763 rigs, the most in two years. EIA data confirmed the higher supply with a rise in total US crude production by 88,000 barrels a day to around 9.34 million barrels at the end of last week.

Gold traded 0.42% lower at $1209/Oz as the precious commodity struggles to hold its current price level. Gold started the week on a resilient note after witnessing a strong sell-off of 2.3% last week amid a broad-based sell-off across the base metals as a result of a rise in the dollar and US real interest rates.