The JSE closed lower on Thursday as industrials and financial stocks took a tumble. Rand hedges and miners were assisted by a weaker rand, with the local unit trading at 13.36 against the dollar at market close. The rand has traded weaker since the announcement that President Jacob Zuma had survived another day after Tuesday’s vote of no confidence failed.

Gold stocks were the shining light on the market on Thursday, after the gold price rallied to $1286/OZ, the highest it has been since June, amid escalating geopolitical tensions between North Korea and the United States.

Safe-haven demand rose after North Korea announced a plan to launch a test strike into the water near Guam, where a U.S. military base is located, shrugging off President Donald Trump's earlier warning.

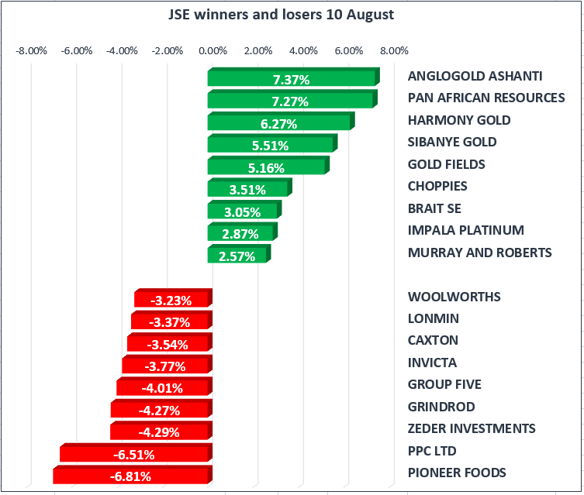

The All Share Index slipped 0.50% whilst the blue-chip Top 40 lost 0.54%. Gold miners gained 6.18% as markets rallied from low base levels. AngloGold [JSE:ANG] gained 7.37% to R130.90 per share.

Pioneer Foods [JSE:PNR] dropped 6.74% as the market reacted to a poor trading statement released after the close on Tuesday. Pioneer announced that group turnover decreased by 4% for the ten months ended 31 July 2017, compared to a 2% increase reported for six months ended 31 March. The decline in turnover has been attributed to lower food prices.

Glencore [JSE:GLN] has raised its earnings guidance, as first half earnings soared, saying it expected the increased take-up of EVs and demand for storage to boost demand for its products. The miner is also continuing to cut debt as it prepares to ramp up acquisitions, with a strong balance sheet providing "headroom for highly selective growth opportunities”.

Manufacturing production declined by 2,3% y-o-y in June, after shrinking by 0,9% in May, narrowly beating market expectations of a 2,5% contraction. The rate of decline was at least slightly softer than the markets expected. Annual declines in output were recorded in six of the ten major manufacturing categories, with the biggest drag coming from ‘petroleum, chemical products, rubber and plastic products’, which fell by 10,6% y-o-y and subtracted 2,6 percentage points, as well as ‘wood and wood products, paper, publishing and printing’, where output shrunk by 4%.

On the domestic policy front, the contested revised Mining Charter will hurt investment spending in the sector. Mining production declined by 0.8% y-o-y in June from a 4.1% increase in May mainly due to a decline in platinum group metals production.

Download GT247.com MobiTrader app and start trading from your mobile phone immediately with R100 000 demo money: