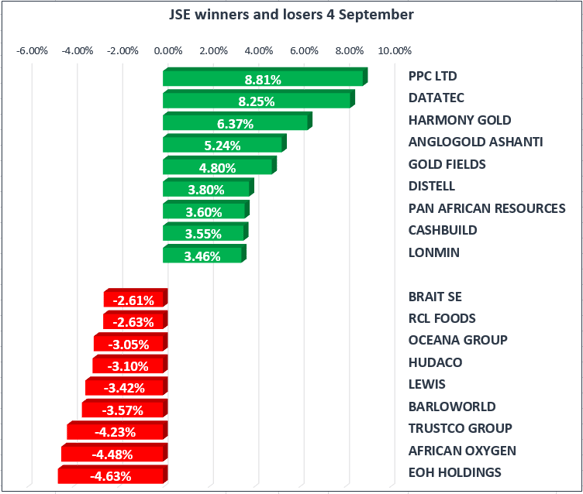

The JSE closed weaker on Monday, as global markets remained weak. Naspers dragged down the Top 40 as the share slipped 1.67% to R2880.51 as Tencent fell 1.29% in Hong Kong.

Markets remained lightly traded due to a public holiday in the United States.

Gold stocks outperformed the market, following a rally in the gold price to a 12-month high of $1337/Oz on Monday, due to heightened geopolitical tensions after North Korea claimed to have tested a hydrogen bomb over the weekend. Seismic data recorded by Japan suggests that these claims could be true.

The test marks a 6th detonation of a nuclear weapon by North Korean military0 in recent months. In response to the nuclear test, U.S. President Donald Trump refused to rule out military action and threatened to cut off trade with any country doing business with the reclusive state.

Harmony Gold [JSE:HAR] climbed 6.37% to R27.90, AngloGold [JSE:ANG] gained 5.20% to R137.58, Gold Fields [JSE:GFI] gained 4.80% to R59.42 and Sibanye moved 2.98% higher to R21.07.

The rand weakened 0.37%, and closed the session at R12.97 against the greenback.

The All-share index fell 0.35%, and the Top 40 slipped 0.40%. The Industrial index traded 0.65% lower, while the Financial index was 0.52% softer. Gold miners gained 4.61% and resources gained 0.51%

In the capital market, bond yields traded lower in line with the firmer rand. The yields on the R207 2020 and the benchmark R186 2025 decreased to 7,18% and 8,57% respectively from 7,31% and 8,58% at the previous week’s close.

Growth in private sector credit extension recorded in July, eased further to 5,7% y-o-y from 6,2% due to slower growth in credit to companies, which dropped by 0,5% over the month and dragged the annual growth rate down to 7,4% from 9,0%. However, household credit increased, with the annual growth rate accelerating to 3,3% after remaining steady at 2,9% for three months.

This week’s economic releases include second quarter GDP numbers, August reserves figures as well as July mining and manufacturing production statistics.