Rand sensitive rally to lead the JSE higher

The JSE closed firmer today as Rand sensitive stocks rallied in a move that surprised most economists.

This rally in Rand sensitive stocks, which includes financials and general retailers, happened despite a relatively weaker Rand against the US Dollar. Retail giant Woolworths (JSE:WHL) was one of the top movers in the JSE Top-40 Index as it closed the day up 2.13%. Banking stocks had a rally after the open and maintained the momentum throughout the day, which saw stocks such as First Rand (JSE:FSR), Barclays Africa (JSE:BGA) and Nedbank (JSE:NED) closing up 1.98%, 1.51% and 1.44% respectively.

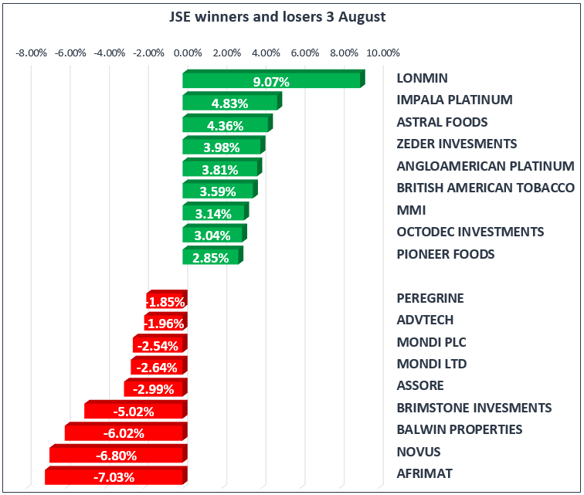

Diversified miners Anglo American PLC (JSE:AGL) & BHP Billiton (JSE:BIL) were also trading in the green with both stocks managing to close up 2.43% and 1.58% respectively. Firmer Platinum prices pushed JSE listed platinum miners higher as Anglo American Platinum and Impala Platinum rallied to gain 3.81% and 4.83% respectively. British American Tobacco continued to stage a comeback as the stock inched up 3.59%.

The JSE All-Share Index closed up 0.88%, whilst the Top-40 Index was up by 0.89%. The Financials Index surprisingly closed up 1.56%, whilst the Resources Index firmed by 1.29%. The Industrials Index managed to close up 0.50%.

In terms of economic data, locally we had the Standard Bank PMI number which came in at 50.1, up from a prior recording of 49.0. In the United Kingdom, the Bank of England kept interest rates unchanged at 0.25% which resulted in the Sterling Pound sliding relative to major currency pairs.

The USA released economic data which caused some volatility in the US Dollar. The Initial Jobless Claims numbers released this afternoon showed a decrease in claims to 240 000 on the back of a forecast of 243 000 claims. The US Dollar rallied slightly on the back of this data but subsequently came under pressure over an hour later after the ISM Manufacturing PMI numbers missed estimates. Investors now shift their focus to the all-important Non-Farm Payrolls numbers expected tomorrow.

Gold was weaker in early morning trading as it reached an intra-day low of $1257.02 per ounce, however the precious metal managed to bounce and track higher from this low. Some of the Gold miners on the JSE turned positive towards the close as Gold had a minor rally, which saw Harmony Gold and Gold Fields closing up 1.58% & 0.86% respectively. Gold was trading at $1268.76 per ounce when the JSE closed.

Palladium traded weaker today falling below $900 per ounce. The commodity was under pressure for most of today’s trading session reaching intra-day lows of $887.18 per ounce. Just after the close Palladium was trading at $893.78 per ounce. On the other hand, Platinum had a good rally as it managed to reach an intra-day high of $964.27 per ounce, and it was recorded at $963.96 just after the close.

Brent Crude inched higher today as it continued to trade above $52 per barrel. This helped Sasol on the JSE as the stock closed up 2.32% at R403.49 per share. Brent Crude was trading at $52.78 per barrel just after the JSE closed.