JSE reverses towards the close to end in the red

South African equity markets ended the day in the red after a sharp reversal towards the close.

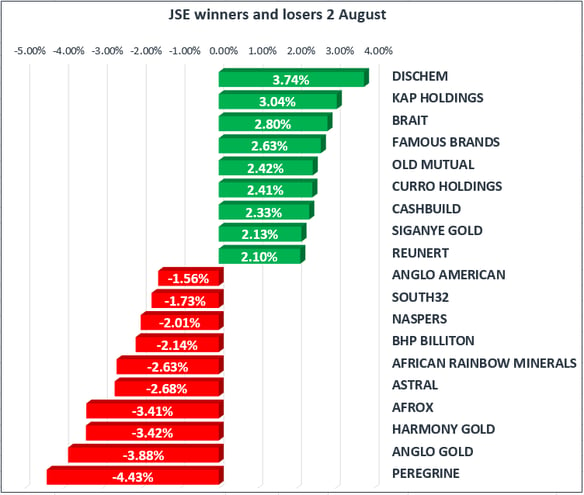

Equities on the JSE started off under pressure as mining stocks were dragged down by weaker commodity prices. Metal commodities took a breather in early morning trading before they bounced and started tracking higher in the afternoon along with the benchmark equity indices. As a result, we saw some of the Platinum miners closing the day firmer, however Gold miners AngloGold Ashanti & Gold Fields traded under significant pressure closing down 3.88% & 1.43% respectively. Towards the close, Naspers weakened further to drag the JSE All-Share Index into the red, as the stock closed 2.10% weaker.

Rand hedge stocks continued to trade firmer as investors looked to take advantage of the weakness in the Rand. Despite a relatively weaker currency, some rand sensitive stocks managed to turn positive towards the JSE close to end the day in the green. Stocks such as Truworths and Standard Bank managed to close the day up 1.20% & 0.44% respectively.

The JSE Top-40 Index closed the day 0.46% weaker, with the broader benchmark JSE All-Share Index weakening by 0.34%. The Financials Index closed up 0.39%, whilst the Resources Index weakened by 1.24%. The Industrials Index shed 0.33% as it was dragged down by Naspers.

On the international markets, the Dow Jones Industrials Index hit yet another record high as it reached 22 000 points. Lately, US equity markets have been driven higher by US company earnings releases which have generally beat analysts’ estimates. Yesterday in particular, Apple released a set of earnings results which beat analysts’ expectations, and given the high weighting of the stock on the Dow Jones this set the tone for today’s open in US equity markets.

On the commodity front, Brent Crude was trading weaker compared to the highs that were recorded yesterday. However US Crude Oil Inventories numbers released this afternoon indicated a decrease in inventories of 1.52 million barrels for last week, on the back of a forecast of a bigger decrease of 3.47 million barrels. There was no significant reaction in Brent Crude prices from this data release, and the commodity was recorded at $51.58 per barrel when the JSE closed.

Gold opened weaker this morning as the US Dollar attempted a minor recovery. The US Dollar Index climbed up above 93 index points in early morning trading but subsequently fell below that level to trade below it for the rest of the day. The precious metal reached a low of $1263.42 per ounce before it managed to bounce and trade in the green for the remainder of the day. The metal was trading at $1270.55 per ounce just after the JSE closed.

Platinum traded in the green for the better portion of today’s trading to reach an intra-day high of $951.42 per ounce. The commodity was up by double digits in US Dollar terms for the day, and just after the close it was trading at $949.96 per ounce. Palladium continued to trade above $900 per ounce after breaking that level in yesterday’s trading session. The commodity reached an intra-day high of $906.78 per ounce and it was also trading in positive territory for the greater part of today’s session.