The JSE ended the day firmer on Monday following a sluggish start which saw it trade briefly in the red.

The local bourse quickly gained momentum as the banking shares and retailers led from the front. This was in contrast to the earlier trend in Asian equity markets where the major indices closed lower.

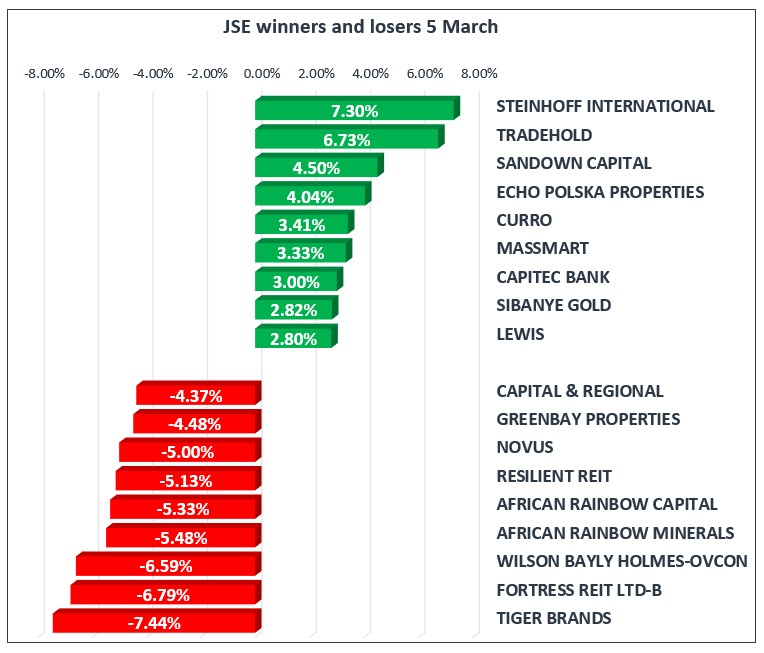

The volatile trade in Steinhoff International [JSE:SNH] continued as the stock gained 7.30% to close at R4.41 per share, which was in sharp contrast to how it traded on Friday. Curro Holdings [JSE:CUR] added 3.41% to close at R33.62 per share whilst Steinhoff Africa Retail [JSE:SRR] gained 1.75%. Capitec Holdings [JSE:CPI] led the banking shares as it gained 3.00% on the back of a positive trading statement to close at R865.48 per share. Other banking stocks such as Nedbank [JSE:NED] and Standard Bank [JSE:SBK] ended the day 0.75% and 0.99% firmer.

Retailers Truworths [JSE:TRU], Massmart [JSE:MSM] and Mr Price [JSElMRP] added 2.08%, 3.33% and 2.44% respectively. Miners Lonmin [JSE:LON] and ArcelorMittal [JSE:ACL] gained 1.50% and 1.75% respectively, whilst Bidcorp [JSE:BID] and index heavyweight Naspers [JSE:NPN] firmed by 1.72% and 1.93% respectively.

On the losers side Tiger Brands [JSE:TBS] came under pressure following the details that emerged about the listeriosis outbreak emanating from one of their facilities. The stock ended the day 7.44% lower at R391.40 per share. Listed property stocks Fortress B [JSE:FFB], Resilient [JSE:RES] and Greenbay Properties [JSE:GRP] resumed their downtrend as they lost 6.79%, 5.13% and 4.48% respectively.

Harmony Gold [JSE:HAR], Impala Platinum [JSE:IMP] and Glencore [JSE:GLN] all traded lower as they ended the day 3.12%, 0.97% and 2.60% lower. Brait [JSE:BAT] also traded softer to end the day 1.67% weaker, whilst Barloworld [JSE:BAW] shed 1.15%.

The JSE All-Share Index gave up some of its gains but it still managed to end the day 0.29% firmer, whilst the JSE Top-40 Index closed 0.39% firmer. The Resources index was the only index to close in the red as it lost 0.68%, whilst the Industrials and Financials Indices gained 0.69% and 0.37% respectively.

The Rand was trading softer earlier as it breached R12/$ to reach a low of R12.02 against the greenback. However it managed to reverse those losses to trade at R11.88/$ at 17.00 CAT.

Gold managed to trade firmer earlier on but it subsequently reversed all the gains to trade softer towards the JSE close. When the JSE closed the precious metal was 0.12% weaker, trading at $1322.11/Oz. This weakness was mainly on the back of a minor rebound in the US dollar.

Palladium did try to gain some momentum earlier on but this quickly faded as the commodity reversed gains to trade in the red for the better portion of today’s session. The metal slid to a low of $979.29/Oz before rebounding to trade at $983.95/Oz just after the close, down 1.02% for the day. Platinum also traded softer as it reached an intra-day low of $957.75/Oz, it rebounded marginally to trade at $958.95/Oz just after the close.

Brent Crude traded firmer in early morning trading as optimism was rife ahead of the meeting in Houston, USA between the oil industry biggest names. The commodity reached a day’s high of $65.07/barrel but that momentum quickly faded as it ended up being recorded at $64.30/barrel just after the JSE close.