The major indices on the JSE ticked lower on Tuesday in line with global equity markets.

The rand traded flat, hovering around R14.45 to the dollar, after the sharp drop seen on Monday. General dollar weakness combined with optimistic German economic data saw the dollar slip against most currencies. Germany reported the fastest pace of growth since the first quarter of 2011. It expanded by 0.8% during the three months to September.

In the capital market, bond yields eased slightly as the local currency gained ground. The yield on the benchmark R186 2025 edged lower to 9.44%

At the close of the JSE, the All-Share index had softened by 0.51% matched by the blue-chip Top 40 slipping 0.48% after a promising start in the morning. Financials traded flat, whilst Resources took a hit of -2.31%, and Industrials -0.07%

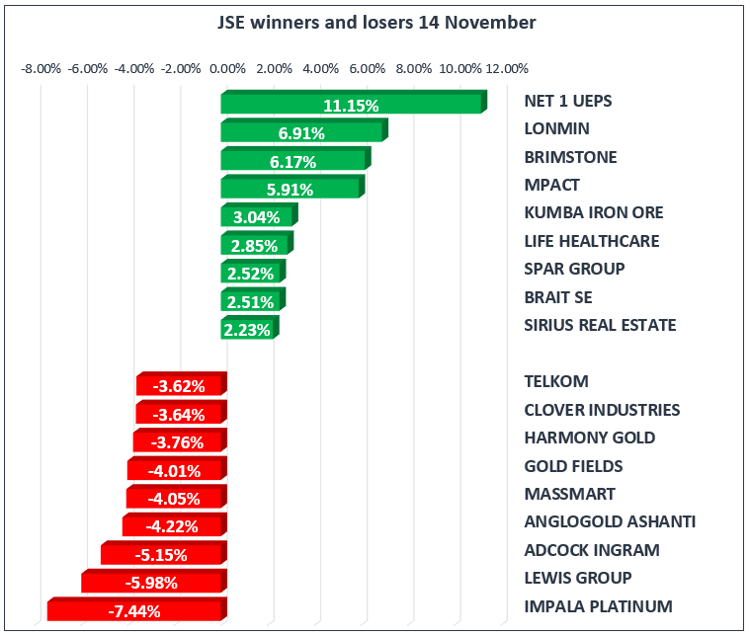

The Gold mining index fell 3.81% with Anglogold [JSE:ANG] falling -4.22% to R137.45, Goldfields -4.01% to R54.75, Harmony [JSE:HAR] -3.76% to R25.36 and Sibanye [JSE:SGL] -3.30% to R19.61

Impala Platinum [JSE:IMP] fell 7.44% to R37.10 dragging the resource index lower. Lonmin [JSE:LON] recovered 6.91% to R12.99, having been under severe pressure of late.

Retailer Steinhoff dropped 2.94% to R53.87 and Massmart 4.05% to R106

Life Healthcare added 2.85% to R25.66. It said in a trading update on Monday that HEPS were expected to drop by up to 60% for the year to end-September.

Gold traded flat at $1278/Oz as prices continued to hold firm above the October lows as the sideways drifting trend for gold continues against a backdrop of strong global equity markets and a rising crude oil price. The Congressional struggle over tax reform may also play into the hands of gold bulls, as many investors on Wall Street are banking on the delivery of a tax reform bill by the end of the year.

Brent Crude eased slightly to $61.29/bbl as expectations that OPEC and other producers will extend their production cut agreement were offset by U.S. drillers adding the most oil rigs in a week since June, indicating output will continue to grow. The increased price of oil combined with the weaker rand is set to squeeze the South African market in the coming months, with the price of fuel directly impacting food and transport costs.

The German economy picked up pace in the third quarter, underpinned by global demand and higher corporate investment. GDP grew at an annualized rate of 3.3%, compared with 2.6% in the second quarter, providing the latest evidence of an acceleration in the eurozone's biggest economy. The figures sent the euro up overnight, rising 0.5% to $1.1724.

Want market news and free trade research direct to your email?