The JSE closed weaker on Wednesday as the current selling pressure in most of the blue chip stocks persisted.

The good news out the local market was inflation data from StatsSA, which indicated that CPI year-on-year slowed down to 4.6% from a prior recording of 4.8%. This is well within the SARB’s target range of between 3% and 6%, and as a result the Rand firmed to an intra-day high of R13.52 against the greenback. The local currency was trading at R13.53 to the US dollar at 5pm.

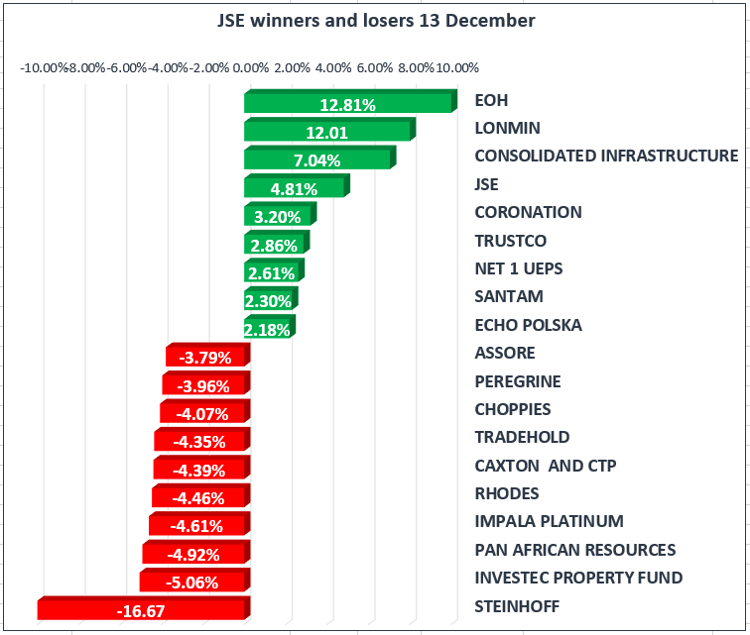

EOH Holdings [JSE:EOH] and Consolidated Infrastructure [JSE:CIL] staged minor recoveries following consecutive sessions of losses, and as a result the stocks closed up 12.81% and 7.04% respectively. Lonmin [JSE:LON] added onto yesterday’s gains to end the day up 12.01%.

Other notable moves higher were recorded in Coronation Fund Managers [JSE:CML] and Brait [JSE:BAT] which gained 3.20% and 0.97% respectively. Banking stocks Standard Bank [JSE:SBK], Nedbank [JSE:NED] and First Rand [JSE:FSR] benefitted from the weaker Rand to record gains of 1.56%, 1.02% and 1.72% respectively. Retailers Pick n Pay [JSE:PIK] and Shoprite [JSE:SHP] firmed by 0.67% and 1.01% respectively.

Steinhoff [JSE:SNH] opened firmer and it was up by more than 20% at some stage. However the stock had a sharp reversal which saw it reversing all the earlier gains end the day down 16.67% at R9.80 per share.

Rhodes Food Group [JSE:RFG] reversed some of yesterday’s gains to end the down 4.46% at R22.70 per share. Construction stocks WBHO [JSE:WBO] and Murray & Roberts [JSE:MUR] traded under pressure to close the day down 2.44% and 2.17% respectively. Miners remained under pressure which saw stocks such as Impala Platinum [JSE:IMP] and AngloGold Ashanti [JSE:ANG] shedding 4.61% and 2.12% respectively.

The JSE Top-40 Index eventually closed the day down 0.31% whilst the JSE All-Share Index also lost 0.31%. The Financials Index gained on the back of the firmer Rand to end the day up 0.54%. The Industrials Index lost 0.56% whilst the Resources Index lost 0.48%.

Gold was mostly flat in today’s session after the minor rebound that was recorded on Tuesday evening. The precious metal managed an intra-day high of $1247.48/Oz, but it failed to gain more momentum as the US dollar was mostly flat. The US dollar did have a small slide after the release of higher US inflation numbers but this did not result in big reaction in the gold price. The precious metal was trading at $1243.16/Oz just after the JSE closed.

Despite a volatile trading session Palladium held on above $1000/Oz to peak at $1016.18/Oz per ounce. Platinum remained under pressure as it lost more than 0.2% to trade at $874.63 just after the JSE close, whilst Palladium was recorded at $1013.55/Oz.

Brent Crude was down by more than 0.4% to trade at $63.29 per barrel just after the JSE closed.

In the USA, the Dow Jones Index and S&P500 index hit fresh all-time highs once again right after the open.