The JSE closed firmer on Friday which was in line with global markets which seemed to have shaken-off their concerns of a trade war and geopolitical tensions.

Global equity markets were buoyed by Donald Trump’s supposed shift in policy stance around trade, as he suggested that he might reconsider the Trans-Pacific Partnership (TPP) trade pact if the terms are better. As a result, emerging market currencies came under pressure as the US dollar came back into favour as investors were slightly less risk-averse.

The Rand weakened against the greenback as a result to reach a session low of R12.09/$. At 17.00 CAT the Rand was still trading softer at R12.07/$.

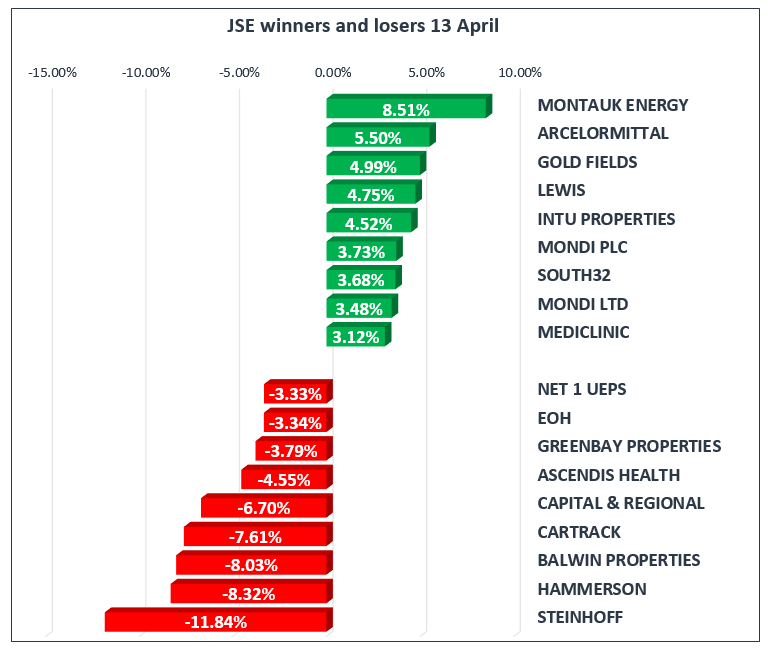

On the broader index Montauk Holdings [JSE:MNK] and ArcelorMittal [JSE:ACL] were among the day’s top gainers after they climbed 8.51% and 5.5% respectively. Exxaro [JSE:EXX] and South32 [JSE:S32] managed to firm by 2.21% and 3.68% respectively. Brait [JSE:BAT] gained 0.67% to close at R37.80 per share.

Group 5 [JSE:GRF] was buoyed by news that the business is looking to move away from the construction business. The stock gained 1.69% to close at R4.20 per share. Rand hedges Richemont [JSE:CFR] and Mondi Limited [JSE:MND] climbed 2.02% and 3.48% respectively, whilst diversified miners BHP Billiton [JSE:BIL] and Anglo American PLC [JSE:AGL] added 1.83% and 2.91% respectively.

Steinhoff [JSE:SNH] came under pressure as it lost 11.84% to close at R2.16 per share. Hammerson [JSE:HMN] which is the target of potential suitors also came under significant pressure to end the day down 8.32%. Naspers [JSE:NPN] and Bidvest [JSE:BVT] weighed on the blue chip index after they lost 2.44% and 1.96% respectively. Aspen [JSE:APN] and Discovery [JSE:DSY] also traded under pressure to lose 0.45% and 0.73% respectively.

The JSE ALL-Share Index eventually closed the day up 0.15%, whilst the JSE Top-40 index also gained 0.15%. The Industrials Index and the Financials Index lost 0.49% and 0.20% respectively, however the Resources Index managed to gain 2.16%.

Brent Crude inched higher to peak at a session high of $72.74/barrel as fears of geopolitical tensions remained. The commodity was trading at $72.44/barrel just after the JSE closed.

Gold jumped by more than 0.7% to peak at a session high of $1346.55/Oz, before it retraced to trade at $1345.31/Oz at 17.00 CAT. Platinum and Palladium also traded firmer and at 17.00 CAT they were recorded at $929.69/Oz and $985.54/Oz respectively.