The JSE edged higher on Thursday on the back of broad-based relief across most major global equity indices.

Despite gains being relatively mild, most of the equity indices managed to hang on to these gains to end the day firmer. In Asia the Shanghai Composite Index closed 0.45% firmer while the Hang Seng closed flat after only adding 0.02%. In Europe, all the major indices advanced while US equity futures also pointed higher. With trade concerns still lingering a lot of risks still remains for riskier assets such as stocks, therefore investors can expect more downside in the near term.

On the currency market, the rand advanced against the greenback despite the latter also gaining on the day. The rand peaked at a session high of R14.13/$ before it came under some pressure towards the JSE close. The rand was trading 0.07% weaker at R14.22/$ at 17.00 CAT.

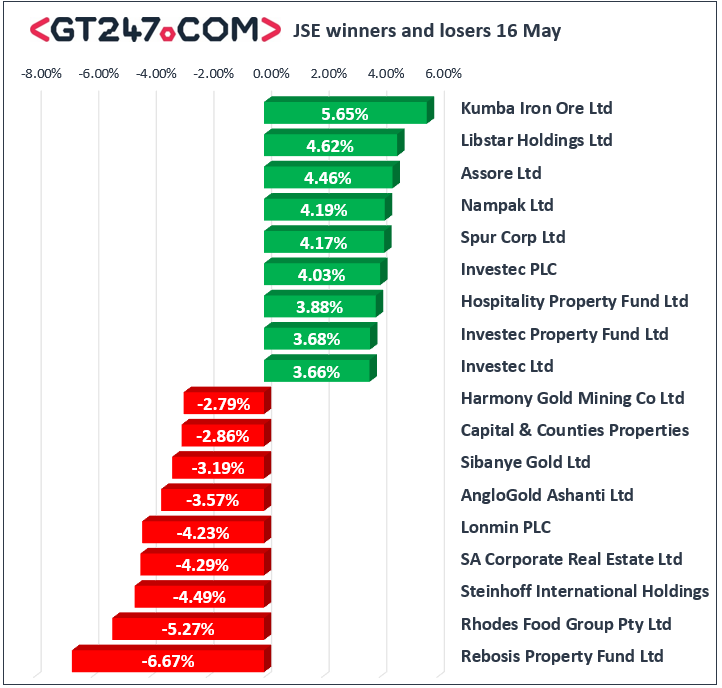

On the local bourse Kumba Iron Ore [JSE:KIO] led the gains as it rallied 5.65% to close at R420.57, while Exxaro Resources [JSE:EXX] extended its gains as it closed 1.86% firmer at R157.80. Nampak [JSE:NPK] also managed to recorded significant gains as it climbed 4.19% to close at R10.94, while sugar producer Tongaat Hulett [JSE:TON] rose 2.3% to close at R21.39. Investec PLC [JSE:INP] was buoyed by the release of its full-year results which reflected decent increases in profit and assets under management. The stock gained 4.03% to close at R92.25. Cement maker, PPC Limited [JSE:PPC] advanced 2.71% to end the day at R5.30, while diversified miner Anglo American PLC [JSE:AGL] added 2.31% to end the day at R357.76. Telecoms provider MTN Group [JSE:MTN] gained 1.14% to close at R100.65, while its sector peer Vodacom [JSE:VOD] closed at R116.85 after gaining 1%.

Steinhoff International [JSE:SNH] featured amongst the day’s biggest losers after the stock fell 4.49% to end the day at R1.49. Listed property stocks retreated as well with losses being recorded for Rebosis Property Fund [JSE:REB] which lost 6.67% to close at R1.26, SA Corporate Real Estate [JSE:SAC] dropped 4.29% to close at R3.35, and Capital and Counties [JSE:CCO] fell 2.86% to close at R42.06. Gold miners retreated further in today’s session with Harmony Gold [JSE:HAR] losing 2.79% to close at R22.26, while AngloGold Ashanti [JSE:ANG] weakened by 3.57% to close at R163.22. Rand hedge Bid Corporation [JSE:BID] lost 1.5% to close at R288.82, while British American Tobacco [JSE:BTI] pulled back to R531.54 after dropping 0.18%.

The blue-chip JSE Top-40 index eventually closed 1.15% firmer while the broader JSE All-Share index firmed 1.03%. Bucking the recent trends, all the major indices advanced in today’s trading session. Industrials rose 0.98%, Financials gained 0.9%, and Resources added 1.08%.

At 17.00 CAT, Palladium was 0.23% weaker at $1341.65/Oz, Platinum was down 1.01% to trade at $838.65/Oz, and Gold was 0.71% lower at $1287.31/Oz.

Brent crude remained bullish as it advanced to peak at a session high of $73.25/barrel. The commodity was trading 2.06% firmer at $73.25/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.