The JSE edged higher on Monday as it took a leaf from Chinese markets which resumed trading after a week-long holiday.

In mainland China the Shanghai Composite Index closed 1.82% firmer while in Hong Kong the Hang Seng managed to add 0.71%. In Europe stocks were also buoyant on the back of minor optimism for the resumption of trade talks between the USA and China. Concerns still linger around global economic growth which has resulted in demand for less riskier assets such as bonds and the US dollar surging.

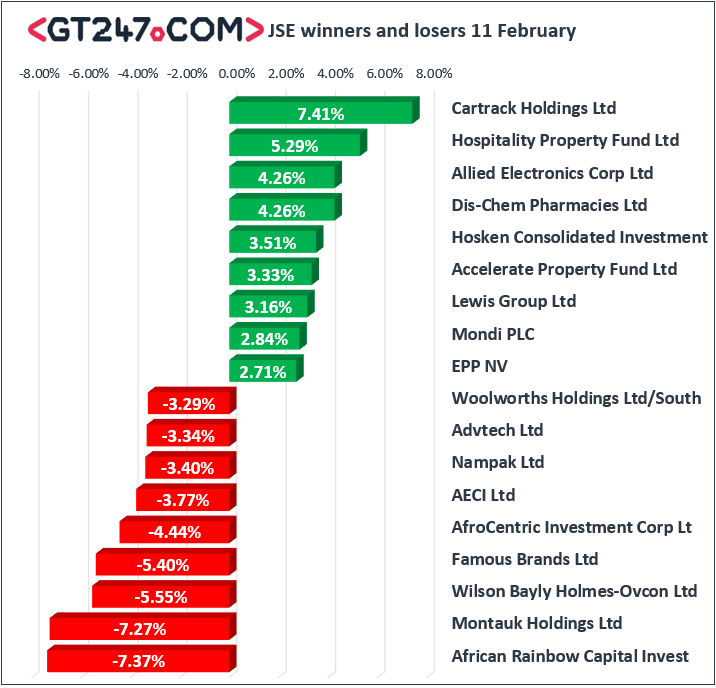

On the JSE, Naspers [JSE:NPN] was buoyed by the gains in Tencent Holdings which closed 1.85% firmer in Hong Kong, which resulted in the stock climbing 1.34% to close at R3030.01. Dis-Chem [JSE:DCP] managed to post gains of 4.26% to close at R25.70, while Netcare [JSE:NTC] added 0.82% to close at R24.46. Sibanye Stillwater [JSE:SGL] continued to rally as the stock rose by 2.39% to close at R14.55, while diversified miner, South32 [JSE:S32] added 1.57% to close at R35.50. Rand hedge, Mondi Ltd [JSE:MND] gained 2.59% to close at R332.86, and Richemont [JSE:CFR] added 1.78% to R93.04.

Woolworths [JSE:WHL] fell mainly on the back of resignations by two independent non-executive directors which saw the stock close 3.29% weaker at R45.80. African Rainbow Capital [JSE:AIL] also traded under pressure as it lost 7.37% to end the day at R4.40. Gold Fields [JSE:GFI] shed 0.44% to close at R47.99, Kumba Iron Ore [JSE:KIO] lost 2.46% to R345.74, and AngloGold Ashanti [JSE:AGL] dropped 0.73% to close at R181.66. The weaker rand resulted in rand sensitives such as Pick n Pay [JSE:PIK] weakening by 1.17% to close at R64.85, while FirstRand [JSE:FSR] lost 1.42% to close at R65.06.

The JSE Top-40 index eventually closed the day 0.47% firmer, while the broader JSE All-Share index gained 0.69%. The Financials index was the only major index to close weaker as it shed 0.57%. The Industrials and Resources indices added 1.44% and 0.41% respectively.

On the currency market the buoyant US dollar resulted in weakness across most emerging market currencies including the rand. The rand fell to a session low of R13.77 before being recorded at R13.76/$ at 17.00 CAT.

Broad based weakness across the commodity market saw brent crude to a session low of $61.15/barrel. The commodity was trading at $61.21/barrel just after the JSE close.

At 17.00 CAT, Palladium was down 1.73% to trade at $1380.02/Oz, Platinum was down 1.49% at $789.02/Oz, and Gold was 0.77% weaker at $1306.41/oz.

Bitcoin was 0.68% firmer at $3694.30/coin while Ethereum was trading 5.03% higher at $124.27/coin.