The local bourse attempted a minor rebound on Tuesday as it opened firmer along with most major global indices before momentum faded towards the close.

The JSE shrugged off weaker closes in Asian markets to open firmer as it tracked European and US equity futures higher. Headlines were grabbed by news that the US Treasury department had determined that China was manipulating its currency, following the slump in the yuan which was recorded on Monday. This has been fanned by the imposition of additional tariffs on Chinese goods by the USA, and now there is a high probability of a bigger hike in the tariffs that the USA could impose.

The rand stabilized in today’s session following the rout on emerging market currencies which ensued on Monday. The local currency strengthened to peak at a session high of R14.76/$ before it was recorded trading 0.17% weaker at R14.93/$ at 17.00 CAT.

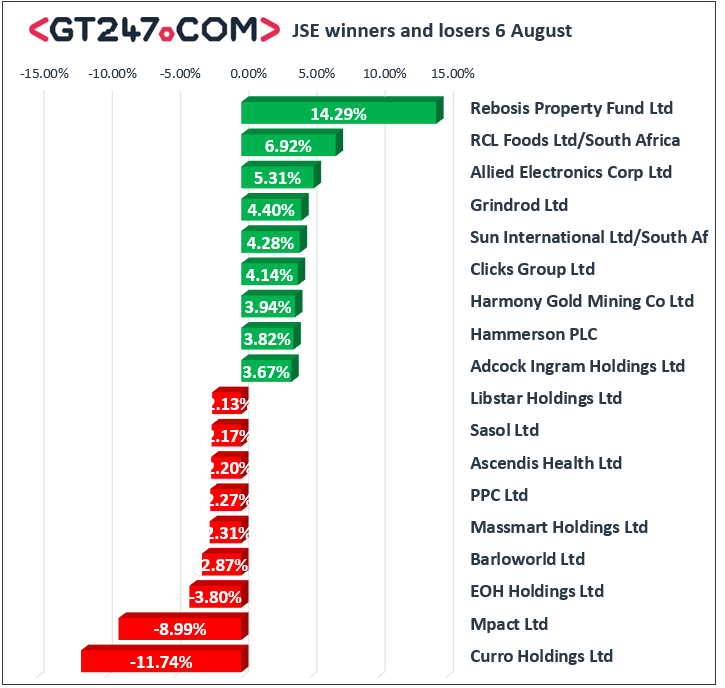

RCL Foods [JSE:RCL] led the gains on the day as it surged 6.92% to close at R11.59, while hospitality group Sun International [JSE:SUI] managed to gain 4.28% to close at R45.10. Retailers were buoyed by the weaker rand which saw gains being recorded for Woolworths [JSE:WHL] which gained 2.67% to close at R55.33, Shoprite [JSE:SHP] which rose 1.62% to close at R157.99, and Mr Price [JSE:MRP] which added 0.64% to close at R179.14. Gold miners continue to benefit from firmer metal prices which have risen on the demand for safe-haven assets. Harmony Gold [JSE:HAR] advanced 3.94% to end the day at R43.00, while Gold Fields [JSE:GFI] firmed 1.82% to close at R87.11. Royal Bafokeng Platinum [JSE:RBP] rose despite a mixed set of half-year earnings results as it climbed 2.65% to end the day at R31.00.

Curro Holdings [JSE:COH] came under significant pressure following the release of its trading statement for the full trading year. The stock plummeted 13.04% to close at R18.00. EOH Holdings [JSE:EOH] retreated by 3.8% to close at R16.45, while Sasol [JSE:SOL] also failed to catch a reprieve as lost another 2.17% to close at R295.00. Barloworld [JSE:BAW] fell 2.87% to end the day at R112.84, while Massmart [JSE:MSM] bucked the trend recorded in other retailers to close the day 2.31% lower at R47.81. Other significant losses on the day were recorded for Glencore [JSE:GLN] which dropped 1.38% to close at R42.06, South32 [JSE:S32] which lost 1.25% to close at R27.75, and Exxaro Resources [JSE:EXX] which closed at R149.41 after losing 1.31%.

The JSE All-Share index held on to its gains to end the day 0.17% firmer while the JSE Top-40 index inched up 0.1%. The Resources index was the only index to close softer as it dropped a modest 0.12%, while the Industrials and Financials indices added 0.35% and 0.01% respectively.

At 17.00 CAT, Platinum was 0.91% weaker at $848.05/Oz, Palladium was up 1.06% to trade at $1437.10/Oz, and Gold had inched up 0.56% to trade at $1472.03/Oz.

Brent crude remained subdued for most of the day’s session as it was recorded trading 0.08% firmer at $59.86/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.